June 16, 2016 – By Mike Cetera

Whatever the reason, your credit score has taken a nose dive. But that doesn’t necessarily mean you can’t get a credit card. You just might not be able to get the card you want.

“First, credit seekers with a bad credit score will find it easier to get a secured card over an unsecured card even though it will require a deposit. Second, it is a much safer bet because payments and interest will be lower,” says Katie Ross, education and development manager at American Consumer Credit Counseling in Auburndale, Massachusetts. “If you can build a history of consistently making payments on time, then your score will improve.”

Secured Credit Card

A secured credit card requires a cash collateral deposit that becomes the credit line for the account. If, for example, you deposited $500 into the account, you would be able to charge up to $500 on the card.

3 steps before applying for a credit card

There are some steps you’ll need to take first before applying for a credit card — secured or unsecured:

- Check your credit report. You want to know what the lender will see when it pulls your credit file. Get your credit report and score today, free and with no obligation, at myBankrate.

- Check your credit score.

- Ask the credit bureaus to fix any mistakes you find in the report, like a credit line that isn’t yours.

What’s a Credit Score?

A credit score is a 3-digit number — roughly between 300 and 850 — that summarizes a consumer’s creditworthiness.

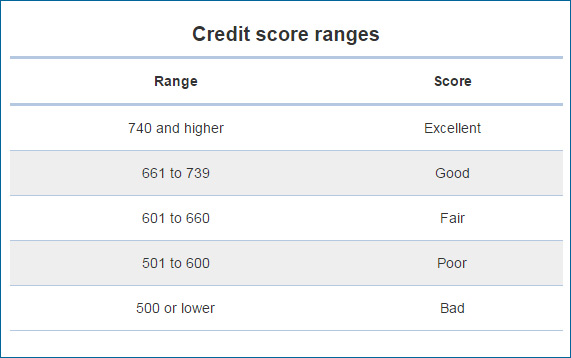

The higher the score, the more able and willing a consumer is to repay a loan, lenders believe. The best interest rates go to borrowers with credit scores of 740 and higher. Generally, a “low” credit score is in the “fair” to “poor” ranges below.

Your credit score will help determine what type of credit card you should apply for. Any score below 600 lenders consider a high risk, meaning they are unsure you’ll repay the loan. If your score is in the 500s, getting an unsecured credit card may prove difficult.

“Once people cross the 600 threshold into higher numbers it increases the possibility that they would qualify for unsecured products,” says Bruce McClary, vice president of public relations and external affairs at the National Foundation for Credit Counseling, a Washington, D.C.-based nonprofit organization

Your credit score will help determine what type of credit card you should apply for. Any score below 600 lenders consider a high risk, meaning they are unsure you’ll repay the loan. If your score is in the 500s, getting an unsecured credit card may prove difficult.

“Once people cross the 600 threshold into higher numbers it increases the possibility that they would qualify for unsecured products,” says Bruce McClary, vice president of public relations and external affairs at the National Foundation for Credit Counseling, a Washington, D.C.-based nonprofit organization.

Your Credit History Counts

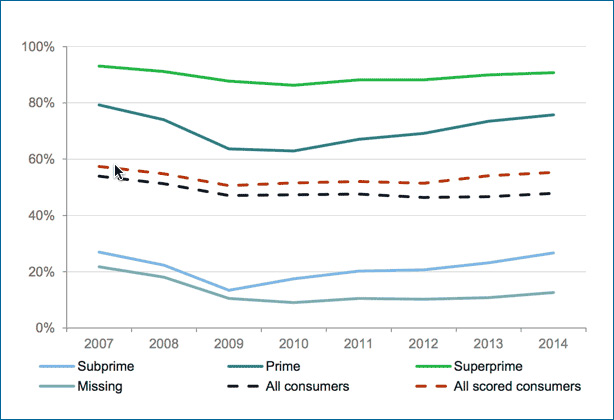

Your credit score alone won’t determine whether an issuer will approve your application. A creditor’s decision will be guided by what’s in your credit report. That may be why nearly one-quarter of all borrowers with a good credit score had their card application denied in 2014, according to the Consumer Financial Protection Bureau.

The odds are far worse for people with poor credit. Issuers approved just 27% of subprime (that’s a credit score below 600) applications, the CFPB found.

The National Foundation for Credit Counseling found 10 reasons that a credit card application might be rejected:

- Not enough existing credit

- Poor repayment history

- Existing lines maxed out

- Overall debt too high

- Too many credit applications

- Serious negative credit marks

- Insufficient income

- Unstable job history

- Too young to apply

- Errors on the application

“If you get rejected when you’re applying for a credit card, that may be a clear sign that you need to stop borrowing for a while,” McClary says.

In that case, he suggests reaching out to a nonprofit credit counseling agency to look for solutions to your financial problems.

But if you’re already addressing the reasons your credit is poor, you may consider applying for a secured card — even if you are eligible for an unsecured card — if the interest rate and fees are better, says Kathryn Bossler, a financial counselor with GreenPath Financial Wellness based in Farmington Hills, Michigan.

“Just because you can qualify for an unsecured credit card doesn’t mean it necessarily will be one you want.”

Questions to Ask When Applying for a Secured Card

There are a few key questions you’ll want to ask of any issuer before you apply. You’ll want to know:

- What is the interest rate charged on the account? “If the borrower does not pay off the balance in full every month, the lender is able to charge interest on the difference,” Ross says.

- What additional fees are associated with the account? “Most credit secured cards charge both an annual fee and a large penalty fee should the borrower go over their limit or miss a payment,” Ross says.

- How long do I have to keep the secured card before I can get an unsecured one? “If you take out a secured credit card and have managed this successfully after about a year to a year and a half, the bank which issued the secured credit card will send you an unsecured card in most cases,” Ross says.

- Does the issuer have affordable unsecured cards that I can eventually graduate to?

- Does the issuer report my payment activities to the credit bureau? They’re not required to, but if they don’t the secured card will not help you improve your credit score. “If they don’t report your payment activity, you’re not doing yourself any favors by getting that card,” McClary says. “It’s just going to be a secret between you and the card issuer.”

Bossler suggests you start first with your bank or credit union. Because you already have a relationship with that institution, it may be more willing to extend credit to you.