55 Percent of consumers use online banking through a website

Boston, MA – June 14, 2017

“There are so many options when it comes to securing and managing your money,” said Steve Trumble, President, and CEO of American Consumer Credit Counseling, based in Newton, MA. “Over the years, the use of computers and mobile phones to access bank accounts has become extremely popular among consumers.”

According to the survey, majority – 70 percent – of respondents have both a checking and savings account. Only 21 percent of consumers claimed to only have a checking account, and a minimal 2 percent say they only have a savings account.

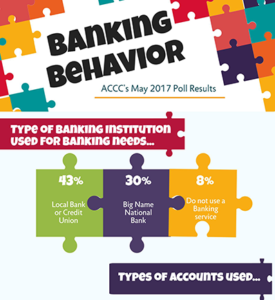

Nearly 43 percent of consumers use a local bank or credit union, followed by almost 30 percent who say they use a big name bank such as Bank of America, Wells Fargo, Chase, etc. Only 8 percent of respondents do not use any banking services.

When it comes to paying bills with an automatic service, 53 percent of respondents say they use automatic billing to a certain extent while 41 percent say they prefer to handle payments individually.

While banks offer many services, 36 percent of consumers say they have used investing, personal loan, credit line or other services and almost 40 percent say they do not make use of these types of services. Of the respondents, 22 percent admit they have yet to try these services, but would consider them if needed.

A study by CreditDonkey found that 8 percent of American households function without a bank account, which is equivalent to 10 million households altogether. Fourteen percent of consumers are still part of “the underbanked,” meaning people with limited access to financial institutions. The survey also found that 39 percent of adults with both mobile phones and bank accounts reported using mobile banking, which is a 33 percent increase in usage from 2013.

The online poll of 134 consumers was conducted by American Consumer Credit Counseling on the organization’s website, www.consumercredit.com. You can view an infographic illustrating the poll results HERE.

ACCC is a 501(c)3 organization that provides free credit counseling, bankruptcy counseling, and housing counseling to consumers nationwide in need of financial literacy education and money management. For more information, contact ACCC:

- For credit counseling, call 800-769-3571

- For bankruptcy counseling, call 866-826-6924

- For housing counseling, call 866-826-7180

- Or visit us online at https://www.consumercredit.com

About American Consumer Credit Counseling

American Consumer Credit Counseling (ACCC) is a nonprofit credit counseling 501(c)(3) organization dedicated to empowering consumers to achieve financial management through credit counseling, debt counseling, bankruptcy counseling, housing counseling, student loan counseling and financial education. Each month, ACCC invites consumers to participate in a poll focused on personal finance issues. The results are conveyed in the form of infographics that act as tools to educate the community on everyday consumer debt issues and problems. By learning more about financial management topics such as credit and debt management, consumers are empowered to make the best possible financial decisions to reach debt relief. As one of the nation’s leading providers of personal finance education and credit counseling services, ACCC’s certified credit advisors work with consumers to help determine the best possible debt solutions for them. ACCC holds an A+ rating with the Better Business Bureau and is a member of the National Foundation for Credit Counseling® (NFCC®). To participate in this month’s poll, visit ConsumerCredit.com and for more financial management resources visit https://www.consumercredit.com/debt-help/.