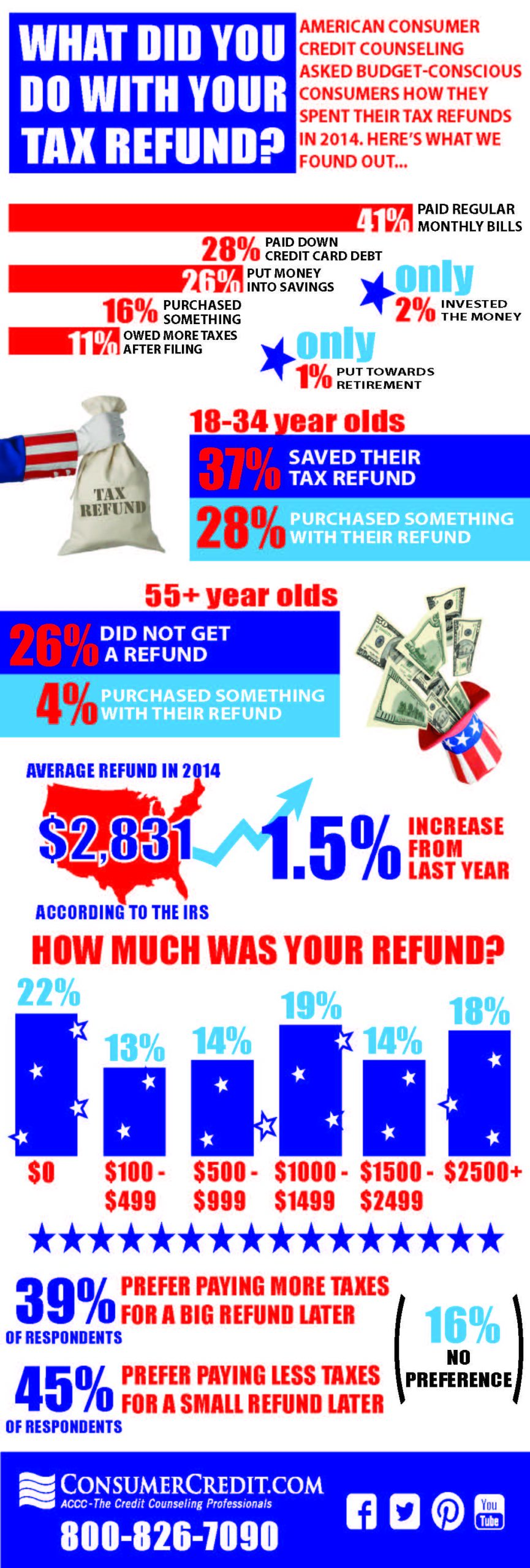

Americans were budget and money conscious with their tax returns this year, according to a survey by national financial education nonprofit American Consumer Credit Counseling. The online survey revealed that 69 percent of American consumers used their tax refund to pay down debt and get ahead on monthly expenses such as rent, utilities and car payments, while only 16 percent splurged and bought themselves something. We asked, and you answered in this month’s poll.

You can embed this infographic on your blog or website! Simply copy the code below and paste it into your website.

<a href="https://www.consumercredit.com/debt-resources-tools/infographics/money-management-infographic/what-did-you-do-with-your-tax-refund/"><img src="https://www.consumercredit.com/wp-content/uploads/2020/06/tax-refund-poll-infographic-scaled.jpg" alt="What Did You Do With Your Tax Refund?" title="What Did You Do With Your Tax Refund?" /></a>