Better Business Bureau A+ Rating

Your Ultimate Money Management App

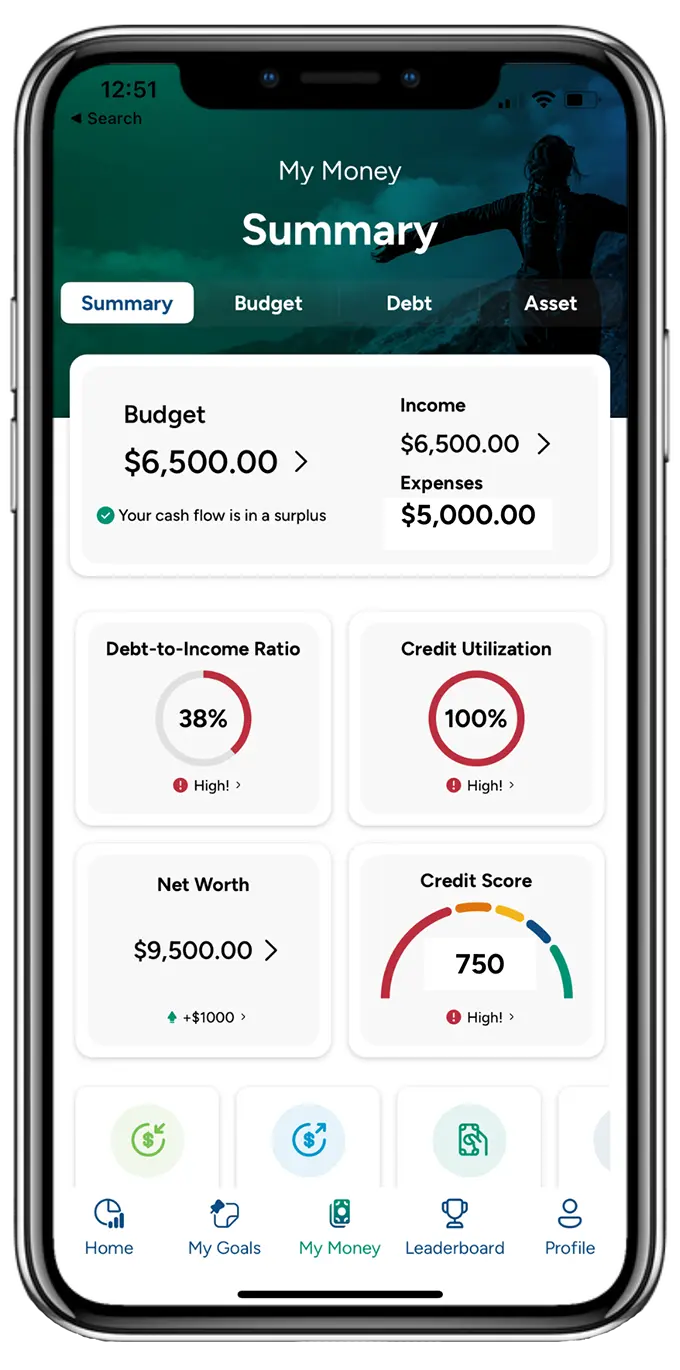

Meet CreditU, the ultimate one-stop debt and financial management app! See your full financial overview, including debts, income, expenses, and savings.

Say goodbye to debt and financial stress, and join the CreditU community today!

CreditU is available now on the App Store and will be available on Google Play in February 2024.

Better Business Bureau A+ Rating

What is a Debt Management Plan (DMP)?

A debt management plan (DMP) is a type of repayment plan that's set up and managed by a non-profit credit counseling agency like ACCC. As part of our DMP, creditors may waive late and overlimit fees, lower interest rates, reduce monthly payments and bring passed due accounts current (also known as re-aging). With many DMPs, the goal is to have your debts fully repaid within three to five years, and in some cases sooner. Once you start the DMP, you'll make a single monthly payment to ACCC, we will then distribute the money to your creditors every month on time.

How We Can Help

How can we help you manage your credit? Our programs can help you take control of your financial life.

Get Started NowCredit Counseling

We will help you determine the best way to approach your financial situation, and provide you the best credit counseling service options possible.

Bankruptcy Counseling

We can provide the mandated pre-filing bankruptcy counseling session to enable you and your legal counsel to make well-informed decisions.

Debt Settlement

We offer free credit counseling sessions with professionally certified counselors to choose the most advantageous path out of debt.

Debt Consolidation

With our debt consolidation plan, you will be able to combine most, if not all of your unsecured debt and make one single monthly payment.

Debt Management

Our debt management program helps simplify your monthly unsecured debt obligations, consolidate your payments, and disburse funds to your creditors on your behalf.

Housing Counseling

ACCC’s housing counselors are available to assist you in all aspects of your housing needs. We provide reverse mortgage counseling, homebuyer education and certification, and foreclosure counseling.

Webinars

Our Community Outreach program works with local & national organizations, companies, financial institutions, schools, and universities to offer free financial education presentations. Our mission is to empower people to become financially independent and to achieve their goals.

About American Consumer Credit Counseling (ACCC):

American Consumer Credit Counseling is a nonprofit credit counseling agency that helps consumers take control of their financial lives through credit counseling, debt consolidation, and financial education. Since 1991, we have been improving lives and providing solutions to people in need of financial help.

Get Started Now