Credit Counseling

Consumer Credit Counseling : What Is It and How Does It Work?

Financial difficulties can be overwhelming, and navigating the world of credit and debt can often be confusing. When you find yourself struggling with debt, credit counseling can be a lifesaver. Therefore, having an in-depth understanding of consumer credit counseling, how it works, and the benefits you can expect from it can help you in your overall money management efforts.

What is Credit Counseling?

Credit counseling is a financial service offered by accredited professionals that helps individuals manage their debt, create a budget, and improve their overall financial situation. This service is designed for people who are struggling with debt or having trouble making monthly debt payments. Credit counselors provide debt advice and support to help clients understand their financial situation, create an effective plan to manage their debts, and work toward a healthier financial future.

Credit counseling companies like American Consumer Credit Counseling (ACCC) are typically nonprofit groups that can offer advice and assistance to people who need help managing money. Using the expertise of a credit counselor offers a wide variety of services and access to financial knowledge and resources. Counselors can also help you organize your debts into a debt management plan to help pay down debts.

>>More: How Can Credit Counseling Help Me

Key Takeaways

-

Credit counseling offers guidance on money, debts, budgeting, and more.

-

ACCC Credit counselors are experts in debt, credit, and financial management.

-

They can help negotiate debt management plans with lenders for better terms.

- Credit counseling is distinct from debt settlement services.

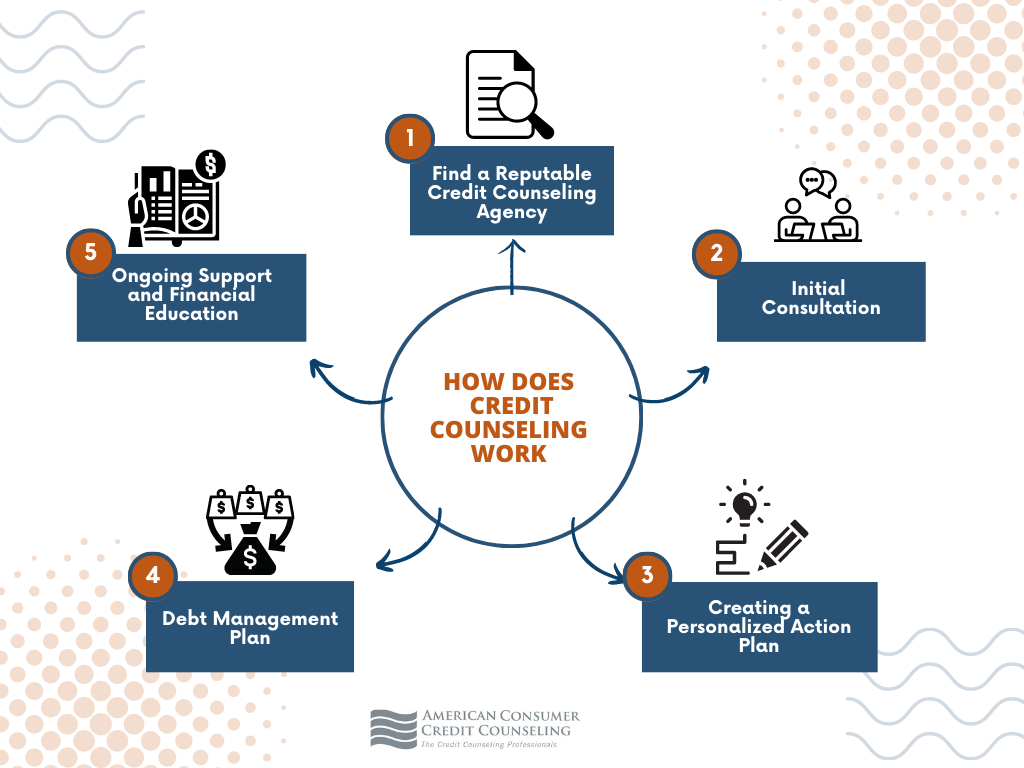

How Does Consumer Credit Counseling Work?

Credit counseling services offer a well-rounded approach to finding effective solutions to your credit card debt problems.

1. Finding a Reputable Credit Counseling Agency

The first step in the credit counseling process is to find a reputable agency. It is crucial to choose an agency that is accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). These organizations ensure that their members adhere to strict standards and ethical guidelines. American Consumer Credit Counseling is a nonprofit credit counseling agency that helps consumers take control of their financial lives through credit counseling, debt consolidation, and financial education. Since 1991, we have been improving lives and providing solutions to people in need of financial help.

2. Initial Consultation

Once you have chosen a credit counseling agency, you will attend an initial consultation. During this meeting, a certified credit counselor at ACCC will review your financial situation, including your income, expenses, and debt. They will also assess your credit report to understand your credit history and financial behaviors.

3. Creating a Personalized Action Plan

After evaluating your financial situation, the credit counselor will work with you to develop a personalized action plan. This plan may include budgeting, debt management , and financial education. The counselor will also help you set realistic financial goals and provide guidance on how to achieve them.

4. Debt Management Plan (DMP)

In some cases, a credit counselor may recommend a Debt Management Plan (DMP). A DMP is an agreement between you and your creditors, facilitated by the credit counseling agency. It allows you to make a single monthly payment to the agency. The credit counseling agency then distributes the funds to your creditors. This can result in reduced interest rates, waived fees, and a structured repayment plan. ACCC experts are most often able to reduce your overall payment with their negotiations with the creditors to help you get out of debt under 5 years.

5. Ongoing Support and Financial Education

Credit counseling does not end with the creation of an action plan or DMP. Counselors provide ongoing support and guidance throughout your financial journey. They also offer educational resources and workshops to help you better understand personal finance and develop healthy financial habits.

What are the Benefits of Credit Counseling?

- Improved Financial Literacy: Credit counseling provides you with the knowledge and tools necessary to make informed financial decisions, helping you build a solid foundation for a stable financial future.

- Reduced Stress: By working with a credit counselor, you can develop a clear and actionable plan to manage your debt, easing the stress and anxiety often associated with financial struggles.

- Lower Interest Rates and Fees: A DMP can help you negotiate lower interest rates and waive fees on your outstanding debts, making it easier to pay off your balances.

- Better Credit Score: As you work with a credit counselor and follow your action plan, you will likely see improvements in your credit score over time.

- Prevent Bankruptcy: Credit counseling can provide an alternative to bankruptcy, allowing you to regain control of your finances without the long-lasting effects of a bankruptcy filing.

Consumer Credit Counseling with ACCC – What Will You Get?

Help assessing your current financial situation.

When you contact an ACCC credit counselor, they will start by helping you evaluate your personal financial situation. They will help you review your income, assets, and expenses. Besides the review, our credit counselors will help you put together a budget. Next, they will explain what steps you can take to deal with your unsecured debt. ACCC provides the counseling session including a budget and action plan at no charge.

Personalized options based on your goals.

After the initial credit counseling session, you will be presented with personalized options based on your financial goals. These options may include services such as a debt management program, social service referrals or bankruptcy counseling,

Development of financial literacy skills.

ACCC has a range of free educational materials and resources to help you develop financial literacy skills. In fact, many educational materials are available to you for free! ACCC also introduced their brand new money management app, CreditU that can help you have a collective view of your financial situation in one place more conveniently.

At the end of the counseling session, you will feel good knowing that there are options available and that you are not alone. Additionally, you can rest assured that ACCC has an A+ rating with the Better Business Bureau. We also have attained a Certificate of Authority in all 50 states.

See if Credit Counseling is Right For You!