Debt Management Program

Debt Management Program Fees

What You Must Know Before Signing Up For a Debt Management Program

Dealing with credit card debt can be a daunting task that often leads to overwhelming stress. Fortunately, there are solutions available to help you with credit card debt relief. Enrolling in a reputable debt management or debt consolidation program can provide a suitable path to overcome debt and regain financial stability. By choosing a reliable credit counseling agency, you can get the right support to tackle your financial challenges and get back on track.

What Do I Need to Know Before Choosing a Credit Counseling Agency?

If you’re considering working with a credit counseling agency, it’s important to understand the cost of consumer credit counseling services before making any decisions. While there are many reputable agencies out there, some may charge excessive enrollment fees, setup fees, and monthly fees that can add up quickly. To ensure you’re making an informed decision, here are some key factors to consider when evaluating potential agencies:

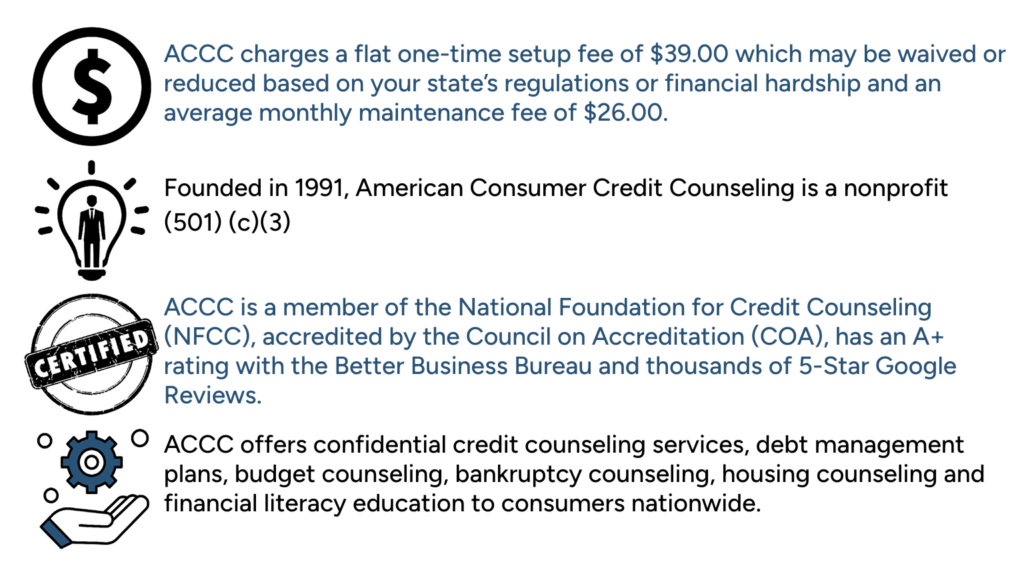

- Fee transparency: A trustworthy agency such as American Consumer Credit Counseling will be upfront about its fees and provide a detailed breakdown of all costs associated with its services.

- Nonprofit status: Consider working with a nonprofit credit counseling agency like ACCC, which typically offers lower fees, unbiased guidance, and access to additional support resources to help you achieve lasting financial stability.

- Accreditation: Look for agencies that are accredited by a reputable organization, such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

- Services offered: Make sure the agency offers services that align with your specific needs, whether that’s debt management, budgeting assistance, or financial education.

By taking the time to research and evaluate potential agencies, you can make an informed decision and find a credit counseling service that fits your budget and helps you achieve your financial goals.

More>> Choosing a Credit Counseling Agency

Important: ACCC charges a one-time enrollment fee of $39 and an average monthly fee of $26*; there are no hidden fees. In addition to this, fees may be waived or discounted depending on your state’s regulations, for financial hardship, or if you are an active service member in the United States military.

ACCC also provides educational programs at no cost to you, as well as ongoing counseling and education. If you choose to work with ACCC, you can be assured that we will be with you every step of the way and provide you with a customized and affordable plan.

Set up Your Debt Management Program

Do You Think You Need Credit Counseling?

The True Cost of Consumer Credit Counseling:

Before working with a consumer credit counseling agency, it’s important to research the true cost of their services to ensure you’re making an informed decision. Here are some factors to consider when evaluating potential agencies:

- What are the fees? Are there any setup fees or monthly fees? Be sure to get a specific price quote from the counselor.

- Most agencies are subject to state law and can charge no more than the maximum allowed within your state. Make sure you ask the counselor about the specific regulations for your state.

- If you are unable to afford the agency’s fees, the agency should be willing to waive the fees if you can’t afford them.

- Be sure the agency is charging you reasonable fees, which can vary by State.

- If the agency asks for a voluntary contribution, you may want to consider another agency. There is no such thing as a voluntary contribution.

- Does the agency charge for educational programs and ongoing education? Be sure the agency is willing to provide you with educational materials and resources to help you learn how to manage your finances. The agency should also be able to provide you with ongoing counseling and education at no charge.

By considering these factors and taking the time to research potential agencies, you can find a credit counseling service that fits your budget and helps you achieve your financial goals.

Set up Your Debt Management Program*The fees are subject to change at any time. For more information, please contact our counseling team.