ACCC offers seven tips to help consumers in Texas improve their credit scores

Boston, MA – October 23, 2019

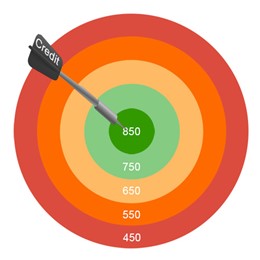

“Credit scores are an indicator of a consumer’s ability to repay lenders, making them an important piece of information lenders analyze when deciding whether to issue a loan or credit card,” said Steve Trumble, President, and CEO of American Consumer Credit Counseling. “The higher a consumer’s credit score, the more likely they are to qualify for loans and credit cards with lower interest rates.”

According to a recent study by Experian, the average credit score in Texas is 659, which is among one of the lowest scores in the United States. Consumers in Texas have an average of three credit cards and carry an average balance of $7,058.

ACCC explains seven tips that can help consumers improve their credit score

- Timely payments – Stay on top of their bills and pay them on time. This includes rent, utilities, phone bills, car loans, and student loans.

- Keep credit card balances low – Credit utilization ratios impact a consumer’s credit score. The ratio is calculated by adding all credit card balances and dividing that amount by the total credit limit.

- Get a higher limit – Getting a higher limit while keeping the balance the same minimizes a consumer’s credit utilization ratio.

- Limit credit card applications – It is important to only apply for credit cards as needed. Unnecessary credit can not only tempt consumers to accumulate debt but can also create inquiries on their credit report.

- Hold on to unused credit cards – Keeping unused credit cards can increase a consumer’s credit utilization ratio, which can help improve their credit score. It is a strategic move as long as there are no annual fees.

- Check credit reports – Consumers need to check their credit report for any inaccuracies as they can have a negative effect on their credit score. Errors on reports could bring their score down.

- Leave old debts on the credit report – Old debt on a consumer’s report might help their score – as long as the payments were timely and completed.

ACCC is a 501(c)3 organization that provides free credit counseling, bankruptcy counseling, and housing counseling to consumers nationwide in need of financial literacy education and money management. For more information, contact ACCC:

- For credit counseling, call 800-769-3571

- For bankruptcy counseling, call 866-826-6924

- For housing counseling, call 866-826-7180

- Or visit us online at http://www.ConsumerCredit.com

About American Consumer Credit Counseling

American Consumer Credit Counseling (ACCC) is a nonprofit credit counseling 501(c)(3) organization dedicated to empowering consumers to achieve financial management through credit counseling, debt management, bankruptcy counseling, housing counseling, student loan counseling and financial education concerning debt solutions. To help consumers reach their goal of debt relief, ACCC provides a range of free consumer personal finance resources on a variety of topics including budgeting, credit and debt management, student loan assistance, youth and money, homeownership, identity theft, senior living, and retirement. Consumers can use ACCC’s worksheets, videos, calculators, and blog articles to make the best possible decisions regarding their financial future. ACCC holds an A+ rating with the Better Business Bureau and is a member of the National Foundation for Credit Counseling® (NFCC®). For more information or to access free financial education resources, log on to ConsumerCredit.com or visit https://www.consumercredit.com/debt-resources-tools/