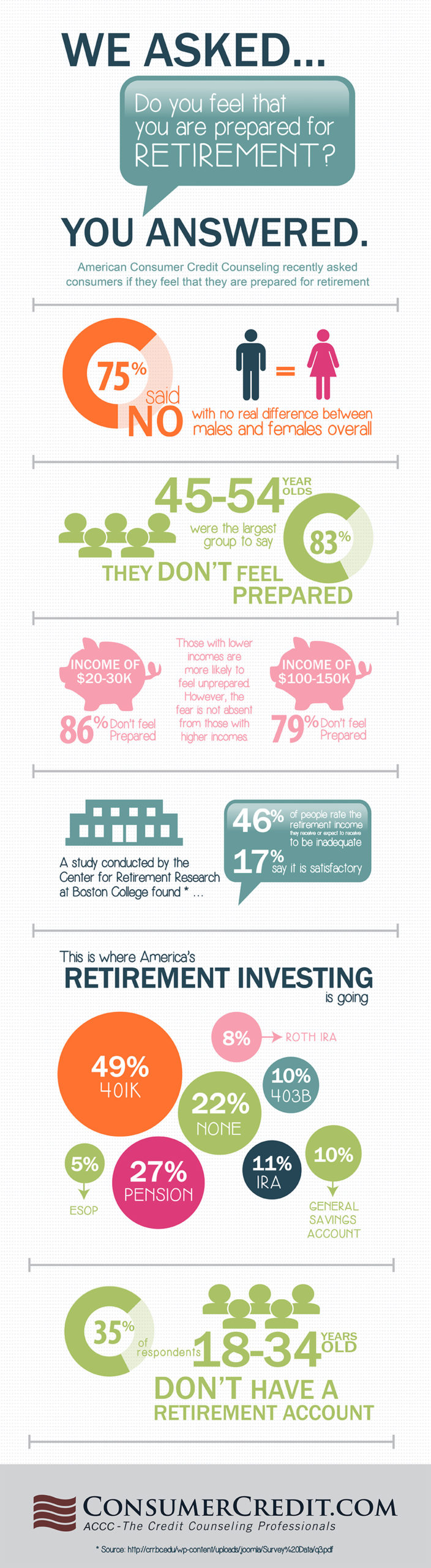

You might think planning and saving for the future is impossible if you are currently drowning in debt and it’s hard to prepare and feel confident in your savings if you are constantly looking for ways to get out of debt. ACCC’s recent poll shows that you are not alone. Approximately 75 percent of respondents feel that they are not adequately prepared for retirement and 35 percent of young respondents are not contributing to a retirement account at all. The poll also showed that the majority of America’s retirement investing is going to 401(k) accounts, but other types of retirement investments are still being made. Check out this comprehensive financial infographic below for a full breakdown of how consumers of different ages and income levels feel about their retirement savings and planning.