What is a Credit Report and Score?

Your success in managing credit is reflected in your credit report and score. A credit report is a history of everything you are doing with your credit now and what you have done with it in the past. A credit score mathematically represents the information in your credit report. Your credit report and score affect your ability to get credit and the terms/rates of that credit. It can also affect your ability to get a job and rent an apartment.

Credit Considered on a Report

- Student loans

- Car loans

- Credit cards

- Personal loans

- Mortgages, home equity loans

- Secured credit cards or Loans

Information Not Considered on a Report

- On-time phone/utility bills

- Debit card use

- Paying with cash

- Writing checks

- Checks cashed

- Remittances

- Income

Other Information on a Report

- Name and aliases

- Social security number

- Current and past addresses

- Date of birth

- Employment history

- Collection accounts

- Inquiries

- Creditor contact information

- Consumer statement

- Public records

- Payment history

- Accounts summary

Positive and Negative Credit History

Lender Perspective:

Positive = Low-risk

- Pay bills consistently and on time

- Maintain reasonable amounts of unused credit

- Apply for credit only when needed.

This keeps inquiries to a minimum - Check credit reports annually and correct any errors that hurt the report

Negative = High-risk

- Routinely paying late on credit cards, utilities, and cell phone bills

- Maxing out limits on credit cards

- Numerous credit applications in a short time period

Credit Scores

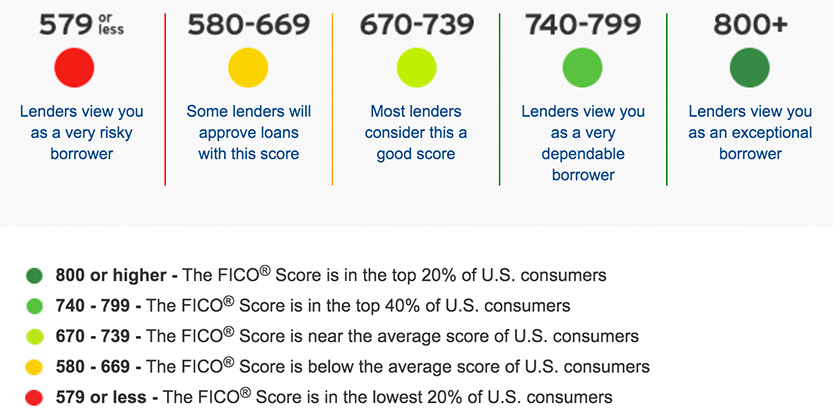

A credit score is a measure of risk based on the information provided by your credit report. The most common scoring system is called the FICO score, where the credit scores range from 300 – 850, with 850 being the best (lowest risk). Over a lifetime, a consumer will pay more for credit (in higher interest rates and fees) if they have a lower FICO score. If you have a low credit score or are in need of debt counseling we can help by obtaining debt counseling.

Source: Fair Isaac Corporation.

How Are Credit Scores Calculated?

Payment History – 35%

The timely manner in which a consumer did or did not repay the debt. This includes all types of credit accounts, late or missed payments, and public records and collection items.

Outstanding Debt- 30%

The total dollar amount of debt currently owed. For credit cards, this means the total amount owed across all accounts in relation to the total credit limit. When a high percentage of the credit limit is already used, this can indicate overextension and a greater likelihood of future missed payments. Keeping credit card balances well below the limits can help this part of the score.

Length of Credit History – 15%

The amount of time the consumer has held credit accounts. This includes how long ago your accounts were established. A longer history helps your credit score.

Pursuit of New Credit – 10%

Opening many new accounts in a short period may hurt a credit score.

Types of Credit in Use – 10%

Analysis of the types of credit a person has in use comparing installment loans, credit cards, retail accounts, mortgage loans, charge cards, etc.

Information Not Calculated in a FICO Credit Score

- Race, color, religion, national origin

- Sex, marital status

- Age

- Salary, occupation, title, employer, employment history

- Where you live

- Overall wealth (assets an individual may have)

A person’s credit score is not the only variable that may be considered by a lender when applying for a loan. Although not included in the credit score, some of the variables noted here may still be considered when a lender reviews a loan application.

Requesting Credit Reports

- By visiting the website:

www.AnnualCreditReport.com - By calling toll free at:

1-877-322-8228 - By sending a written request to:

Annual Credit Report Request Service

PO Box 105281,

Atlanta, GA 30348-5281

BEWARE… The website above is the ONLY website supported by the Federal Government for free annual credit reports. There are other sites that use “free report” in their names or advertisements. They might also misspell AnnualCreditReport.com as their web address in the hopes that consumers will arive at their site instead by accident. Theirs is a pay service, and not supported by the Federal Government.

It is recommended that consumers check each of their three credit reports once a year to ensure the information is accurate. They do not have to be requested all at once. A consumer can stagger their requests from each credit reporting agency every 4 months to constantly monitor the information.

Mistakes in Credit Reports

Of all the complaints posted to the Consumer Financial Protection Bureau’s website in 2016, the highest percentage were complaints about credit reporting. The Federal Trade Commission found that one in four consumers identified errors on their credit reports that might affect their credit scores. In 1971, the Fair Credit Reporting Act was enacted to protect the consumer. It states that consumers have the right to know what information is in their credit report, and to correct any errors. This legislation was designed to promote accuracy and ensure privacy of consumer information in credit reports. Here’s what to know to correct an error on a credit report:

- Tell the credit reporting company, in writing, what information you think is inaccurate.

- Tell the information provider, in writing, that you dispute an item on your credit report.

- The agency has 30 days to investigate the information.

- Information must be removed from a file if the CRA cannot verify it, or correct the errors.

Building a Credit History

To start building a positive credit history, individuals should acquire and positively manage small lines of credit. The following are credit options for individuals who need to begin building a positive credit history:

- Authorized User/Cosigner: For young adults (18 years and older), obtain a credit card with a parent or guardian as a co-signer.Co-signers on an account are equally responsible for the loan. Therefore, the loan is on their credit report as well, making a positive or negative impact depending on how the credit is managed.

- Small credit building loan from a bank: Acquire a small loan for an item for which the individual already has money available in a separate account. Then, set up automatic withdrawals to make the payments. Using a local bank or credit union where the individual already has a checking or savings account usually works best.

- Obtain a secured credit card or loan: Secured cards and loans typically require a cash or collateral security deposit to ensure payment of the debt. The larger the security deposit or collateral, the higher the credit limit granted. The cash security deposit is returned when you close the account with the balance fully paid back.

Tip: Before applying for credit, call and ask what the minimum requirements are.

Credit Inquiries

A credit inquiry is a request for an individual’s credit report. Inquiries are made by a variety of businesses that have a purpose to view a consumer’s credit report, such as insurance agencies, current and potential credit companies, financial institutions, landlords, and potential employers (with the potential employee’s permission). Different types of credit inquiries impact an individual’s credit score in different ways.

Soft Inquiries

Soft inquiries occur when the credit report is examined for informational purposes only, not for credit decisions. This includes when a consumer checks his/her own report, credit card companies pre-approving consumers for lines of credit, or pre-employment checks. Soft inquiries DO NOT affect an individual’s credit score.

Hard Inquiries

Hard inquiries occur when the consumer gives permission to a company to check their credit report when applying for additional credit. For example, if an individual applies for a new credit card, automobile loan, insurance, or opens a new cell phone account, the credit score will be impacted and the information will stay on the credit report for 2 years.