April 18, 2018 – By Ben Luthi

If your score meets or beats that average, it’s enough to put you in the good credit score range, which goes from 670 to 739. As a result, you should have a good chance of getting approved for some of the best personal loans for good credit.

How Your Credit Impacts Your Personal Loan Qualification

Each personal loan company has its own credit criteria for applicants, but in general, lenders start with credit score ranges.

“It’s simple: The higher your credit score, the lower the interest rate and better terms of credit you’ll receive,” said Katie Ross, education and development manager for American Consumer Credit Counseling.

A high credit score is a sign that you have experience using credit responsibly and that you’re less likely to miss payments or default on your loan. Consequently, people with great credit scores typically qualify for the lowest interest rates lenders offer because such borrowers pose less of a risk to the lenders.

“In addition to your credit score, lenders may look at the credit report itself,” said Ross. “They’ll also look at your income and expenses, loan term, and employment history.”

The Best Personal Loans for Good Credit

To improve your chances of getting a low interest rate, you need to know where to look. To save you time, we’ve done the research and found five personal loan lenders that offer great rates to people with good credit.

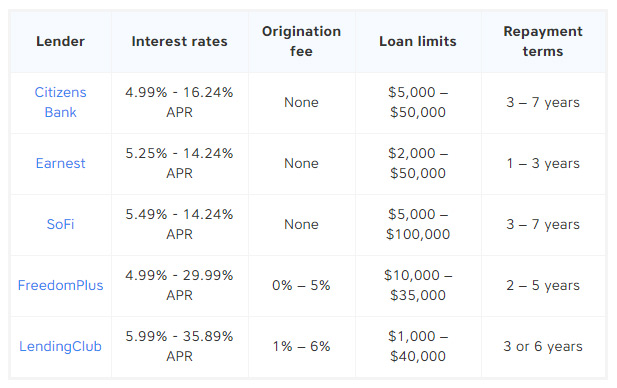

Here’s a summary of the best personal loans for good credit, their interest rates, and other relevant terms, as of April 18, 2018. For the latest rates and information, contact the lenders or visit their websites below.

Citizens Bank: Up to a 0.50% Interest Rate Reduction

Citizens Bank doesn’t charge any fees to get you started, and it matches SoFi for the most flexible repayment options. The bank has a high maximum loan limit, but it might not be a good choice if you need to borrow less than $5,000.

One thing that sets Citizens Bank apart from the rest is its rate discount offers. You can get up to a 0.50% rate reduction — 0.25% for having a qualifying Citizens Bank account when you apply for the loan and an additional 0.25% for setting up automatic payments on your loan.

Earnest: Doesn’t Just Check Your Credit Score

Earnest offers one of the lower minimum loan thresholds on our list, and it doesn’t charge any origination or other hidden fees. But the lender might not be a good choice if you need more than three years to repay your loan.

In addition to checking the typical credit factors, Earnest also looks at criteria such as your savings patterns, 401(k) and other investments, employment history, and growth potential. So, if your credit score is barely in the good range, you might still get a great interest rate if these other factors are strong.

SoFi: Offers Protection if You Lose Your Job

Like Citizens Bank, SoFi offers flexible repayment terms, and it has the highest loan limit of any of the lenders we researched. You’ll also get a 0.25% interest rate reduction if you set up autopay, and an extra 0.125% rate discount if you already have a SoFi loan. But if you need less than $5,000, it might not be a good fit.

If you apply with SoFi and other lenders and get similar rate offers, SoFi’s unemployment protection program could be a tie-breaker. Not only can you qualify for forbearance on your loan payments for up to 12 months — in three-month increments — but you can get help from a team of career coaches to return to the workforce.

Freedomplus: Low Rates for Some but High for Others

While FreedomPlus offers the lowest rate among any of the personal loan companies we reviewed, its origination fee could increase your APR to more than what you’d pay with the other lenders.

Also, it’s high minimum loan amount makes the lender a poor choice unless you need to borrow at least that much.

Lendingclub: Watch Out for the Origination Fee

LendingClub offers the lowest minimum loan amount among any of the lenders we listed, making it a good choice if you don’t need a lot of cash. It also offers the widest range of interest rates, so be sure to compare the lender with others to get the best rate.

As in the case of FreedomPlus, LendingClub’s biggest disadvantage is its origination fee. It’s the only lender on our list of the best personal loans for good credit that charges an such a fee on every loan.

Which Personal Loan Should You Choose?

The best personal loans for good credit offer great interest rates. To make sure you get the lowest rate possible, it’s crucial that you compare personal loans from several lenders.

“Shop around for the best rate in a personal loan that will fit your financial circumstances,” said Ross. “Compare the amounts, monthly payments, and interest rates. Your local credit union or bank may offer lower interest rates and more flexible terms.”

Many of these lenders allow you to get a personalized rate with just a soft credit pull, which won’t hurt your credit. Use a personal loan calculator to see how your monthly payment changes based on your interest rate and repayment period.

As you take the research we’ve done and do a little of your own, you’ll improve your chances of getting a low rate and paying less money over the life of your new loan.