ACCC explains why knowing the difference between net and gross income is so important to living a healthy financial life

Boston, MA – April 2, 2018

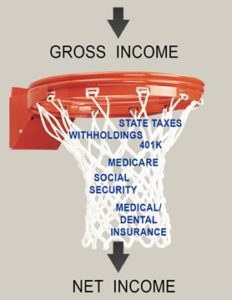

“When planning your expenses and setting a budget, it is imperative that you look at your net income rather than your gross income,” said Steve Trumble, President, and CEO of American Consumer Credit Counseling, which is based in Newton, MA. “That means you should identify the amount of money you have coming in after deducting costs, such as taxes, retirement contributions, and social security. Creating your budget based on net income is crucial to living a healthy financial life.”

According to the IRS’s preliminary data, the average American taxpayer owed $9,655 in federal income tax during the 2015 tax year. With the average gross income at $71,258, the federal income tax rate was 13.5 percent. Although state and local income taxes vary depending on where you live, the U.S. Census Bureau estimates that Americans pay an average of about nine percent annually in state and local income taxes.

Gross income is a person’s total income earned before taxes, and other deductions are taken out. Earned income includes salaries, wages, bonuses, tips, and self-employment income.

Net income is a person’s income earned minus deduction and taxes, which include Federal, State, local income taxes, FICA, Social Security, and Medicare. Other deductions may consist of dental insurance, health insurance, retirement contributions, dues, donations, etc.

Withholdings on a paycheck include federal income tax, Social Security, Medicare, and state and local income tax. How you adjust your withholdings has a direct impact on your paycheck. Be sure you review the federal and state withholding forms and apply accordingly.The more money that is withheld from your paycheck, the smaller the paycheck but, the greater the tax refund will be. If too little is withheld, then it is likely a person may owe taxes at the end of the year. Other deductions on paychecks include retirement benefits or health care costs, which may vary business to business.

ACCC is a 501(c)3 organization that provides free credit counseling, bankruptcy counseling, and housing counseling to consumers nationwide in need of financial literacy education and money management. For more information, contact ACCC:

- For credit counseling, call 800-769-3571

- For bankruptcy counseling, call 866-826-6924

- For housing counseling, call 866-826-7180

- Or visit us online at ConsumerCredit.com

About American Consumer Credit Counseling

American Consumer Credit Counseling (ACCC) is a nonprofit credit counseling 501(c)(3) organization dedicated to empowering consumers to achieve financial management through credit counseling, debt management, bankruptcy counseling, housing counseling, student loan counseling and financial education concerning debt solutions. In order to help consumers reach their goal of debt relief, ACCC provides a range of free consumer personal finance resources on a variety of topics including budgeting, credit and debt management, student loan assistance, youth and money, homeownership, identity theft, senior living and retirement. Consumers can use ACCC’s worksheets, videos, calculators, and blog articles to make the best possible decisions regarding their financial future. ACCC holds an A+ rating with the Better Business Bureau and is a member of the National Foundation for Credit Counseling® (NFCC®). For more information or to access free financial education resources, log on to ConsumerCredit.com or visit https://www.consumercredit.com/debt-resources-tools/