American Consumer Credit Counseling’s ‘Financial Health Index’ finds nearly 80 percent of respondents have been impacted financially by COVID-19

Boston, MA – March 30, 2020

The ACCC Financial Health Index found nearly 80 percent of those surveyed have been impacted by the shutdown of entire economic sectors and other effects from the spread of the novel Coronavirus to more than 740,000 people worldwide, and over 140,000 in the U.S. alone. COVID-19 has claimed over 35,000 lives around the globe.

“Our Financial Health Index was created to measure how Americans are feeling about their household finances as well as the overall U.S. economy. As we find ourselves amid an unprecedented crisis, the picture right now is bleak,” said Steve Trumble, President, and CEO of American Consumer Credit Counseling. “Income security, financial stability, and household debt levels are all major pressing issues on the minds of American consumers.”

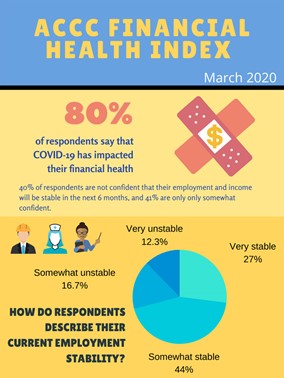

The poll of 430 Americans – aged 25-65 with incomes of $100,000 or less – found that 29 percent have been “significantly impacted” financially by COVID-19, while close to 50 percent have been at least “somewhat impacted.”

Additionally, a combined 55 percent of those polled said they were either “not so confident” or “not confident at all” in the U.S. economy right now. In comparison, just 13 percent reported being “very confident.” Forty-one percent of respondents said they were “uncomfortable” in some way with their current household income, and 40 percent lack confidence in their ability to reduce their household debt by at least 10 percent over the next six months.

The ACCC Financial Health Index poll has a margin of error of plus-or-minus 6 percent. (An infographic is attached below depicting select results.)

A record 3.3 million Americans filed for unemployment benefits in the past week, according to the Labor Department – more than four times the prior history of 695,000 unemployment claims during one week in 1982. Thousands of businesses have been shuttered nationwide as a result of quarantines, stay-at-home orders, social distancing measures, and the resulting plummet in demand for almost anything not considered essential goods or services. Lawmakers in Washington have approved a $2 trillion economic stimulus and relief package to try and shore up the economy as the U.S. grapples with COVID-19 and tries to control the rapid pace of infection.

Those who are in the direst circumstances responded in smaller, but not insignificant, numbers. The poll found 12 percent consider their current employment “very unstable,” 16 percent have lost all confidence in the U.S. economy, and 16 percent have almost no ability to pay down debt.

“We are experiencing a historic economic event brought on by this global pandemic. Americans need immediate financial assistance and support to get their households and families through this crisis,” Trumble said. “They will also require budget counseling, assistance from creditors through forbearance and payment deferral, and flexibility from mortgage banks and landlords on housing payments.”

Some positive findings: The Financial Health Index found 70 percent of respondents consider their current employment “stable,” and 60 percent still feel confident in their prospects for continued employment six months from now. The poll also found 52 percent feel their debt-to-income ratio is either “somewhat healthy” or “very healthy,” with 60 percent still in a position to pay down debt.

Financial counselors at ACCC continue to provide callers with budget counseling and assistance with creditors while providing further assistance through ConsumerCredit.com and the ACCC Talking Cents blog. Counselors are also directing clients to resources such as the Ready.gov section on financial preparedness, and the downloadable EFFAK (Emergency Financial First Aid Kit) guide.

About American Consumer Credit Counseling

American Consumer Credit Counseling (ACCC) is a nonprofit credit counseling 501(c)(3) organization dedicated to empowering consumers to achieve financial management through credit counseling, debt management, bankruptcy counseling, housing counseling, student loan counseling, and financial education concerning debt solutions. To help consumers reach their goal of debt relief, ACCC provides a range of free consumer personal finance resources on a variety of topics including budgeting, credit and debt management, student loan assistance, youth and money, homeownership, identity theft, senior living, and retirement. Consumers can use ACCC’s worksheets, videos, calculators, and blog articles to make the best possible decisions regarding their financial future. ACCC holds an A+ rating with the Better Business Bureau and is a member of the National Foundation for Credit Counseling® (NFCC®). For more information or to access free financial education resources, visit Consumer Credit Counseling.