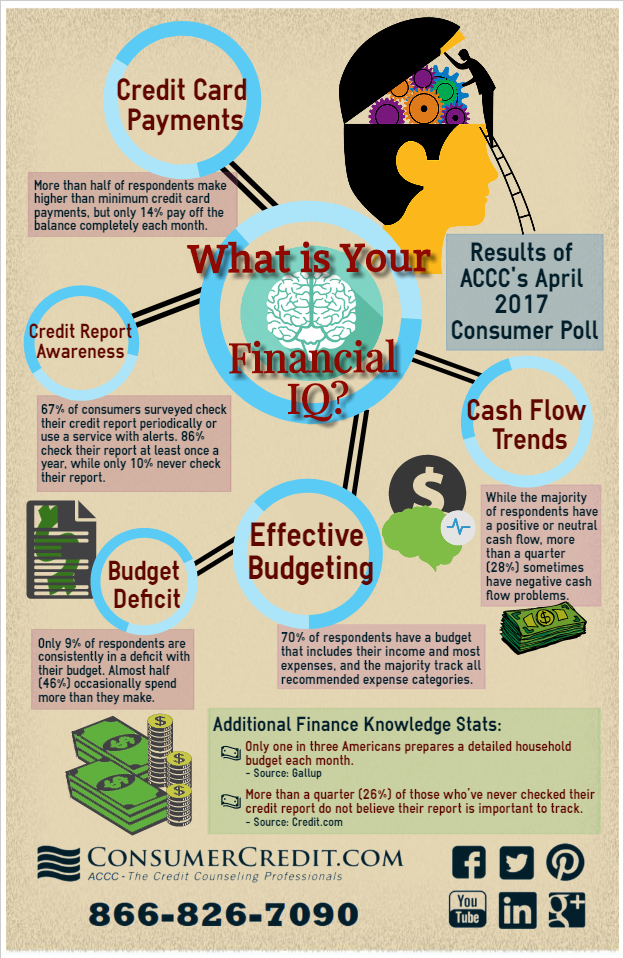

American Consumer Credit Counseling’s poll in the month of April, which was National Financial Literacy Month, focused on understanding consumers’ money awareness or financial IQ. The results are in. More than 70% of the respondents polled have a budget that includes most of the essential spending categories. Additionally, the majority of consumers who responded pay more than the minimum toward their credit cards each month, which is critical for debt management. Unfortunately, 28% are frequently experiencing negative cash flow, and almost half (46%) occasionally spend more than they make in a month. While our results show that consumers are relatively knowledgeable, a Credit.com survey showed that 26% of consumers who’ve never checked their credit report do not believe that tracking their credit is important for financial health!

With just under 170 respondents, ACCC’s April poll reveals some interesting stats on Financial IQ that you can see on this month’s infographic.

Click on the image to see full-size pdf

If you are looking for debt advice, schedule a free credit counseling session with us today.