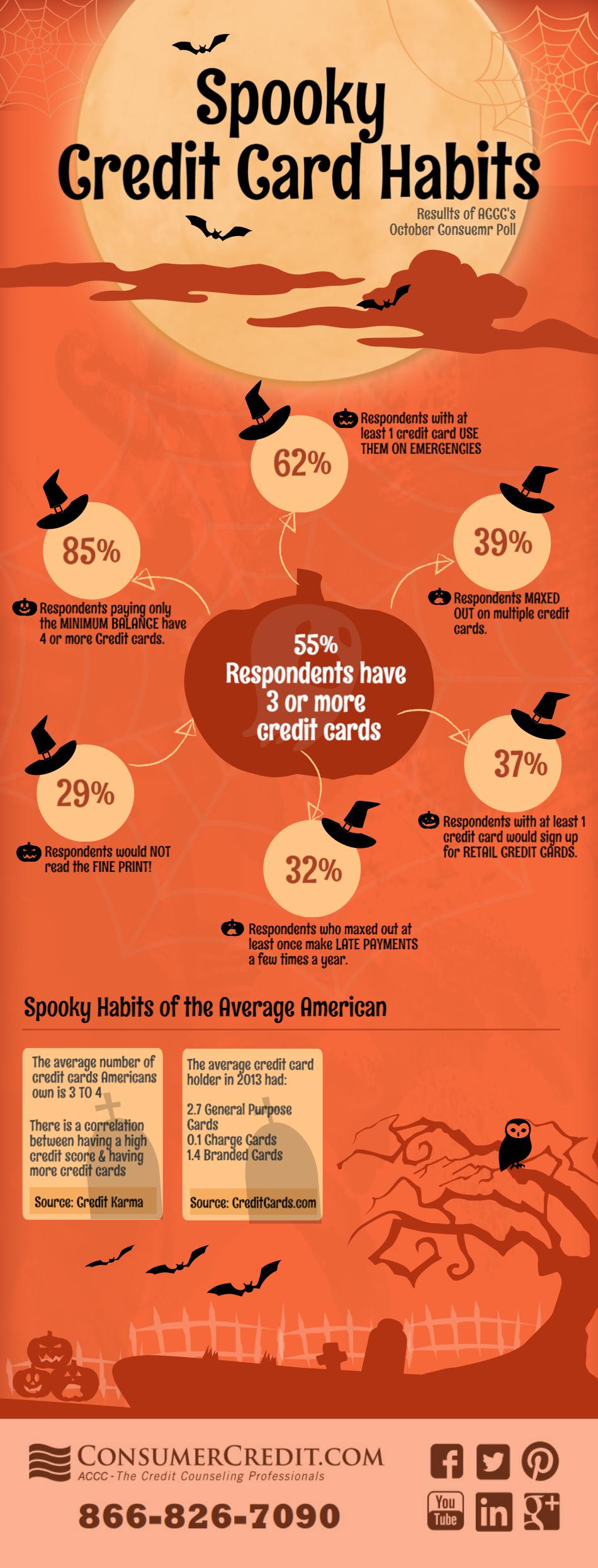

With Halloween in the air, the month of October was the perfect time to dig in deep about some of the spooky credit card habits that may be holding back your financials. According to the Federal Reserve date released in 2014, 72 percent of consumers had at least one credit card. Credit cards are a necessity in building a good credit record. However, the responsible use of credit cards is what’s going to lead you towards financial stability. Therefore, it is key that consumers try to avoid any scary credit card habits. These habits may include anything from balance transfers, maxed out cards, late payments or too many credit cards. See the latest infographic from American Consumer Credit Counseling for more interesting facts. If you’re dealing with scary debt, don’t hesitate to reach out for debt management help, too!

Click on the image to view the full-size PDF

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.