Creating and adhering to a realistic budget while in college will help limit the amount of debt you will graduate with. It will also limit the temptation to use credit cards, which are often targeted at college students. Using credit responsibly is important to building and maintaining credit; however, it should not be used for everyday expenses. A budget will help you plan for everyday expenses and limit the need for credit.

When creating a budget in college, there are several factors to consider. First, it is important to include your family to be sure everyone is on the same page about who will pay for what and when. Next, it is important to define a timeframe for your budget. Will you create a budget each week, month, semester, or year?

Start by listing all of your income. This can include financial aid, scholarships, student loans, savings, funds from parents or family, and of course any income from part-time or work study jobs. Then, list all of your expenses. Typical expenses for college students include: books, school supplies, rent or room and board, groceries or a meal plan, transportation, clothes, entertainment, etc. By comparing and contrasting your total income and expenses, you will have a realistic view of your spending and a feasible budget plan. If you do not know exactly what your expenses or income are, carefully track them for a week or a month each semester to get a realistic idea.

Your budget should also include expenses outside of the everyday necessities. Be sure to plan for emergencies. You never know when your car may break down or you may need a costly root canal.

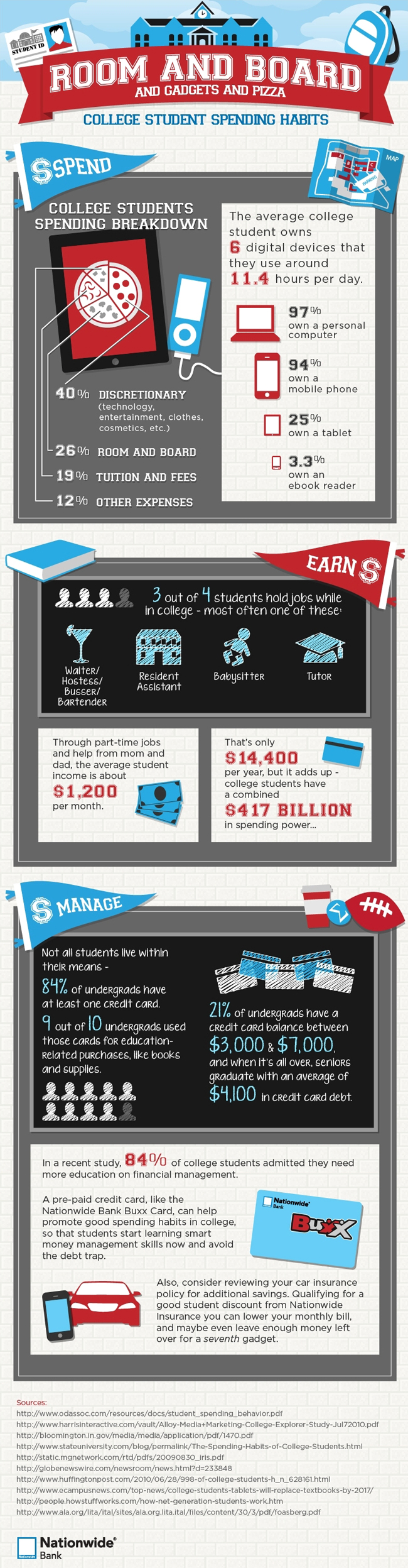

College Student Spending Habits

Here’s an infographic from Nationwide Bank that looks at college student spending habits — how much they earn, what they spend, and how they manage their money.

ACCC provides links to other services but does not endorse non-ACCC websites or validate their content. To see how to get your debt down fast get a free debt management plan.