Considering a sears credit card and wondering which is the right one for you?

We took a look at the two Sears credit cards and we think neither is a great option, even for frequent Sears and Kmart shoppers. You may be able to benefit more from a flexible cash back credit card.

October 3, 2018 – By Lyn Mettler

We’ll show you exactly what’s beneficial and what to look out for with these department store credit cards, and explain why a more flexible cash back credit card may be a better bet.

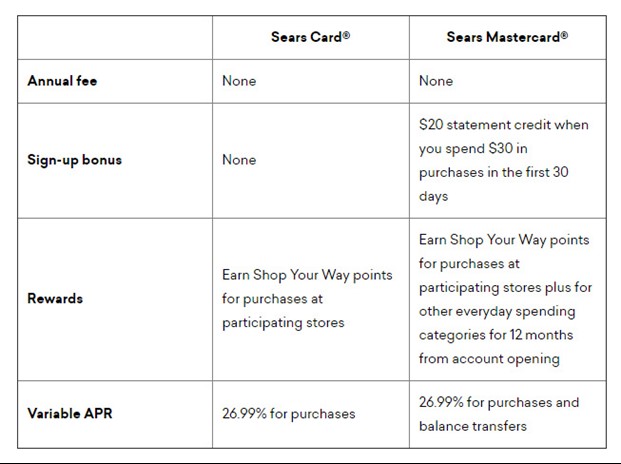

At a Glance: Sears Card® Vs. Sears Mastercard®

Which Sears Credit Card Has the Best Rewards Program?

Sears and Kmart participate in the Shop Your Way points program, which allows you to earn points on your purchases at a variety of participating retailers, including Sears, Kmart, Lands’ End, The Great Indoors and MyGofer.com.

With the Shop Your Way program, you’ll earn at least 10 base points for every $1 spent. Points can then be redeemed for items both online and in store at a handful of retailers, including Sears and Kmart. One thousand points equal $1 when you redeem.

Holders of both the Sears Card® and Sears Mastercard® are automatically enrolled in the Shop Your Way program. But those with the Sears Mastercard® have the added opportunity of earning additional points for purchases in certain categories, such as gas and groceries, rather than specific retailers, for the first 12 months from account opening.

However, the points you earn through Shop Your Way can only be used at participating retailers, like Sears and Kmart. In contrast, flexible cash back cards often allow you to use the cash you earn wherever you want (depending on how you redeem it).

Which Sears Credit Card Has the Best Sign-up Bonus?

Of the two Sears credit cards, only one has a sign-up bonus. The Sears Mastercard® offers a $20 statement credit when you spend $30 in purchases within 30 days of being approved for the card.

While saving $20 might seem appealing, you could earn a more-significant sign-up bonus from other cash back credit cards like the Chase Freedom® . This card offers a $150 cash back bonus after you spend $500 in purchases in the first 3 months from account opening.

Other Sears Credit Card Benefits

Neither Sears credit card offers great benefits other than occasional deferred-interest promotions, which may give you low interest for your purchases for a set amount of time.

However, if you don’t pay off the balance in full by the end of a specified promotional period, all the interest on that purchase is then charged to your account (and these cards charge high interest rates). Consider if it’s worth the risk.

Heads Up: What to Consider When Applying for a Sears Credit Card

While these cards may offer deals that sound appealing as you’re standing at the register, you could end up paying more in interest than you bargained for. You’ll also be sacrificing the flexibility that can come with general cash back and rewards cards.

“Store credit cards can be tempting, especially when they come with immediate and sometimes deeper discounts on your purchases,” said Katie Ross, education and development manager for American Consumer Credit Counseling.

But it’s important to consider if a promotional rate is worth the risk of high interest in the event you can’t pay the balance before the promotional window ends.

Along with the high interest rates, you should also consider the potential impact on your credit. Ross warns that credit limits are generally low on retailer credit cards. Coming close to your limit on a card can impact your credit utilization, which is a factor in determining your credit scores.

In Ross’ opinion, “Consumers are better off using a secured card that they may already have instead of a snap decision of applying for a store card to save on that day only.”

Bottom Line: Which Card is Right for You?

Ultimately, neither Sears card is a great option.

For those looking for a retailer credit card, consider the Costco Anywhere Visa® Card by Citi or the Amazon Prime Rewards Visa Signature Card. Both have lower APRs for purchases and offer a wealth of other benefits like no foreign transaction fees and travel accident insurance.

“Everyone’s needs are different, but you’ll generally get more long-term value out of signing up for a flexible rewards card, with a decent sign-up bonus and which has a standard [annual percentage rate],” says Pursuing Points’ Peter Foti.