March 4, 2020 – By Dhara Singh

“Most of the people in our study are using credit cards to just get by and are living paycheck to paycheck,” Madison Block, a marketing communications and program associate at ACCC, told Yahoo Money.

The analysis of over 40,000 consumer clients who sought budget counseling since 2018 noted that carrying credit card balances of $20,000 “is more than double the debt of the average household carrying credit balances, and more than three times the average credit card debt of all households in the U.S.”

This led researchers to identify a “tipping point” for households in debt.

“That tipping point refers to the amount of debt ($20k+) that consumers have accumulated when they realize they need outside help,” ACCC explained to Yahoo Money in a statement, adding that “a lot of these clients have a debt load that’s half of what their income [is] annually. That’s definitely a significant and alarming debt-to-income ratio for most people.”

‘They’ll End Up With 5,6 and Sometimes Even 7 Cards’

The troubling trend of carrying credit card debt has grown over the years. Two decades ago, the average balance for those seeking help hovered only around $8,000, according to the ACCC. Five years ago, the average balance was $15,423.

And while experts say the responsibility falls on the cardholders to make sure they’re paying off their balances, it doesn’t help that credit card companies will increase the limits for those who need extra credit.

Last quarter, credit card limits summed $3.9 trillion, while just 10 years back that amount was $2.87 trillion.

“When I was in college, Capital One provided me with a credit card limit of $19,000 and I utilized all of that within 8 to 9 months for college expenses, books and travel,” Oleg Yavorovskiy, founder of Guardian Debt Relief, a debt settlement firm, told Yahoo Money. “Then, they offered to extend my credit by $4,000.”

Yavorovskiy said he finds his clients over the years, enticed by retail discounts, also take on more credit cards than they can handle.

“People will have one credit card and when they start getting offers from stores such as Target or Walmart, they’ll end up with five, six, and sometimes even 7 cards,” Yavorovskiy said.

The ACCC study also found that the average household seeking budgeting assistance has 5.60 credit cards with interest rates even higher than 20%.

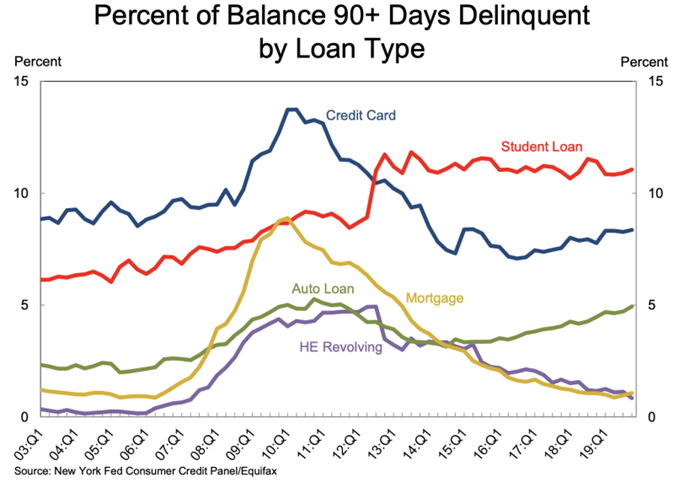

The percentage of U.S. credit card debt that were seriously delinquent (90+ days) stood at 5.32% as of Q4 2019. (Source: New York Federal Reserve)

Debt Isn’t Only an Issue at the Bottom of the Salary Totem Pole

Yavorovskiy noted that it’s important to understand household debt is an issue permeating all income levels.

He recalled a client of his who worked as a retail banker at Chase bank and had accumulated around $250,000 in private student loan debt.

“When you have that much debt coming out of college, it’s very difficult to make payments,” Yavorovskiy said. “[Fortunately,] we were able to settle that private student loan debt for 40 cents on the dollar and downsize that amount to $85,000.”