Consumers have a range of products, goods and financial products constantly at their disposal. However, the temptation can be too much! Budgets are easily blown, and then debt happens. In this Weekly Round-Up, we will look at consumer product news and how to avoid overspending.

Consumer Product News Headlines

- “Here’s why a majority of millennials are rejected for loans, credit cards” by Fox Business

- Apple reverses stance on iPhone repairs and will supply parts to independent shops for the first time by CNBC

- Movie ticket prices have steadily risen since you were born by USA Today Money

- New, higher tariffs could raise the prices of these Chinese-made products by USA Today

As you can tell, there is a range of products reviewed in the above headlines. Entertainment, financial products, tech and more are just a few examples in the consumer product news. Additionally, these categories often cause financial grief to Americans racking up consumer debt.

Here are some tips to avoid overspending and sticking to the budget.

- Avoid impulse shopping. Sleep on it and see if the purchase is truly worth it.

- Don’t upgrade your technology at a moment’s notice. Wait until it breaks or doesn’t work properly enough.

- Make a budget and stick to it.

- Plan out SMART financial goals.

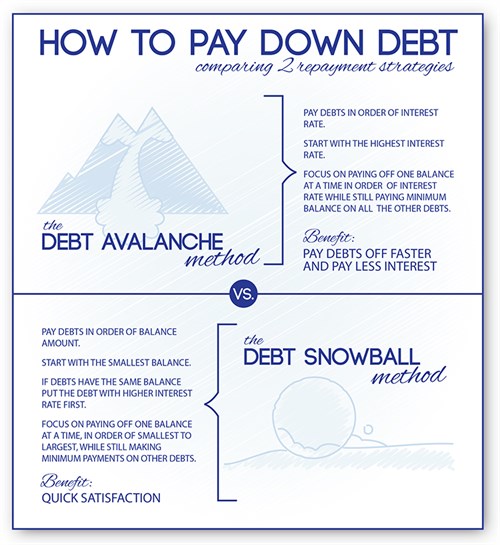

- Pay down debt as quickly as you can- Debt Snowball or Debt Avalanche.

- Actively save.

- Have an emergency fund.

- Don’t use credit cards unless you can pay off the balance every month.

- Find cheaper entertainment options to fit in the budget. Check local movie theatres for discount screenings, for example.

Keeping tabs on consumer product news can help you to buy when the market is good- and in the budget!

If you’re struggling to pay off debt, ACCC can help. Sign up for a free credit counseling session with us today!