Credit card debt can get pretty extreme. In December 2022, the national average credit card debt among cardholders with unpaid balances was $7,279. If you’re in this kind of situation, know that you’re not alone and that help is available. As a nonprofit credit counseling agency, ACCC has been helping consumers pay off debt for over 30 years. Here are 5 tips on how to handle credit card debt.

1. Create a budget: Start by creating a comprehensive budget to understand your income and expenses. Review your bills, statements, and receipts from a given month to track where your money is going.

2. Analyze and reduce spending: Once you have a budget in place, identify areas where you can reduce expenses and save money to allocate towards your credit card payments. These could be things like premium streaming services, going out to eat, or shopping for fun. Freeing up as much money as possible for debt is crucial.

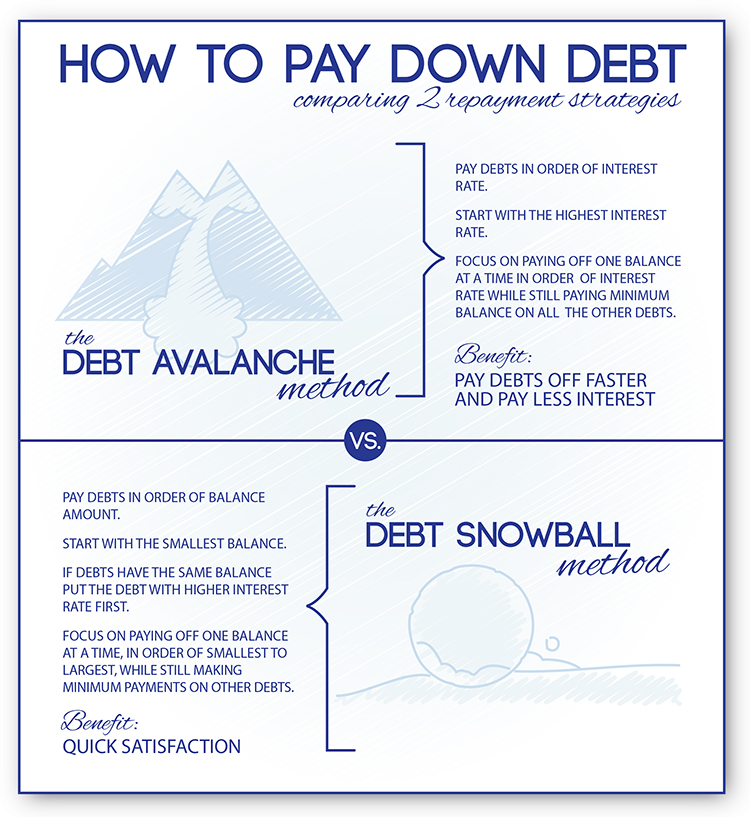

3. Choose a repayment method: Two common strategies for credit card debt repayment are the Debt Avalanche and the Debt Snowball methods. Check out the infographic below to see how these methods work.

4. Contact your creditors: Reach out to your creditors and discuss potential options to make paying off your debt more manageable. Some creditors may be willing to temporarily reduce your interest rate or waive certain fees. It’s worth contacting them to explore any potential assistance they can provide.

5. Seek counseling: If you’re still struggling to make progress with your credit card debt, consider professional help. Research reputable credit counseling agencies and reach out to them for assistance. A reliable agency will offer free budget analysis and credit counseling, presenting you with suitable options to pay off your credit card debt. Watch the video below to learn more about finding a reputable credit counseling agency.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.