Our debt counselors know that the bankruptcy process is a stressful time in life. It means you are facing financial catastrophe. Therefore it is important that consumers understand this process, its advantages and disadvantages thoroughly. So, do you know enough about filing bankruptcy?

Filing Bankruptcy – Advantages & Disadvantages

What is Bankruptcy?

Bankruptcy is a proceeding in a federal court in which an insolvent debtor’s assets are liquidated and the debtor is relieved of further liability. There are two types of bankruptcy:

- Chapter 7 that deals with liquidation

- Chapter 13 that deals with reorganization

The decision about filing bankruptcy is incredibly difficult. Therefore, it is best for consumers to be aware of all the alternatives available to them. It is important that consumers get advice about filing bankruptcy early and understand the process if they are considering this option for debt relief.

Advantages & Disadvantages of Filing Bankruptcy

Advantages:

- Consumers can obtain a fresh financial start.

- If you are eligible for Chapter 7, most of your unsecured debts may be forgiven or discharged. A secured debt is one which the creditor is entitled to collect by seizing and selling certain assets in lieu of missing payments. These include a home mortgage or car loan.

- You may be able to keep (that is, exempt) many of your assets. However, state laws vary widely in defining which assets you can keep.

- Collection efforts must stop as soon as you file for bankruptcy under Chapter 7 or Chapter 13.

Disadvantages:

- A bankruptcy can remain on your credit record for 7-10 years. It can affect your future finances and ability to borrow funds.

- A bankruptcy can impede your chances of getting a mortgage or car loan for some time.

- You cannot discharge all your debt by simply filing for bankruptcy. Examples of such debt include child support, alimony, some student loans, divorce settlements and some income taxes. You should check with an attorney on the specific categories of debt that allowed for discharge.

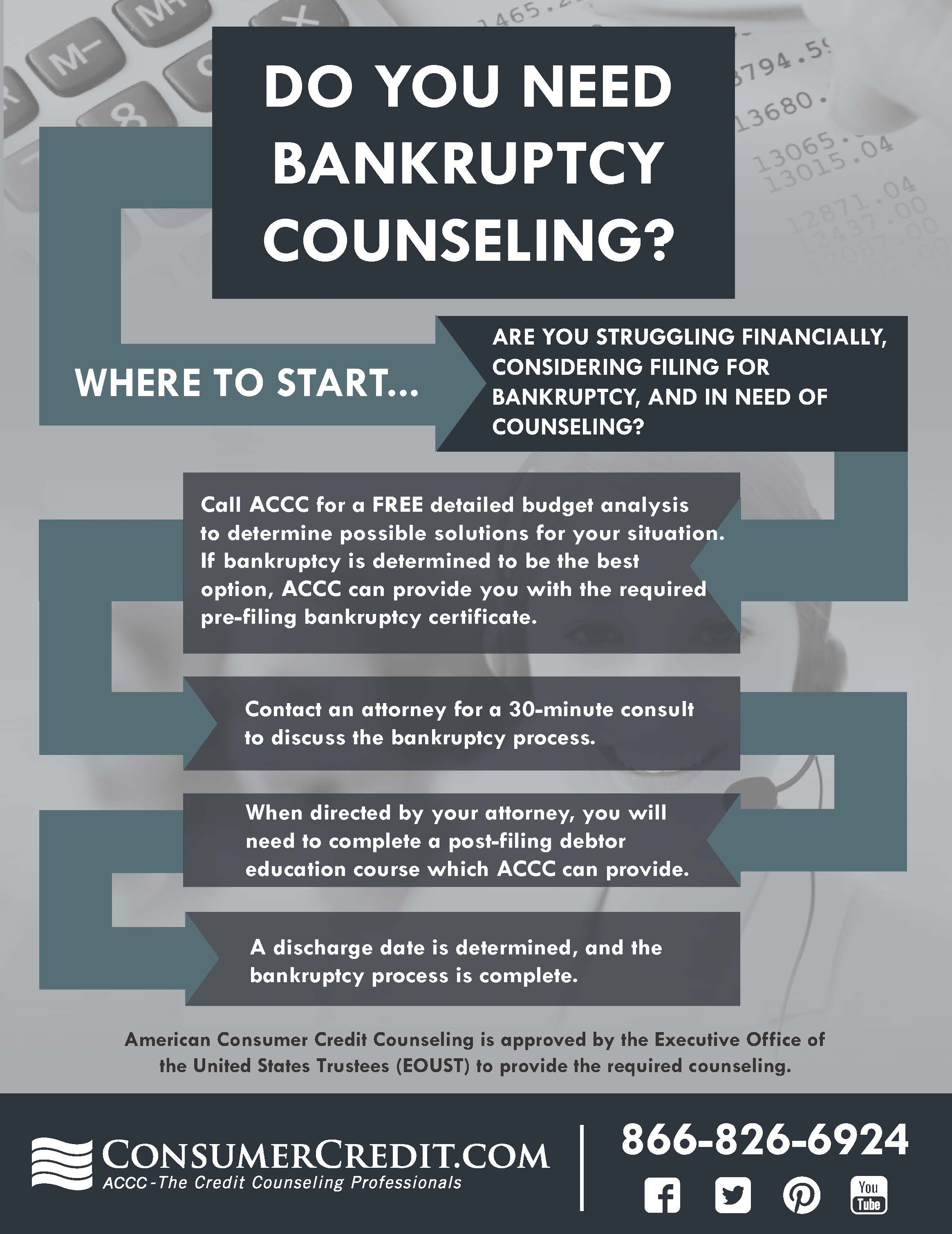

Check out ACCC’s infographic on understanding bankruptcy.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.