Before choosing a debt settlement program, make sure to study it well. You want to be sure it’s the best decision for your money in the long run.

Before choosing a debt settlement program, make sure to study it well. You want to be sure it’s the best decision for your money in the long run.

The Risks of Debt Settlement Services.

Debt settlement services sound very promising – who wouldn’t want to settle their debt for pennies on the dollar? But there are serious risks you should understand before hiring a settlement services company.

Here’s how settlement services work: you stop paying bills to your creditors, and after your accounts are in serious delinquency, the debt settlement company steps in and tries to get your creditors to settle your debts for less than what you owe.

Does debt settlement work? Sometimes. Companies may be willing to settle your debt if they think it’s the best deal they can get. But they may also choose to sue you for payment, add more penalties and interest to your total and send a collections agency after you. Even if you can settle your debt, you’ll owe a big fee to the settlement services agency as well as taxes on any forgiven debt. Either way, your credit rating will be damaged for years to come.

So, is debt settlement a good idea? Not if you’re trying to build a strong financial future. A poor credit rating will likely prevent you from getting credit, taking loans, or even renting an apartment or buying a home.

When you want to know how to settle debt effectively, it’s important to get debt settlement advice from a trusted financial professional like the credit counselors at American Consumer Credit Counseling (ACCC).

Important

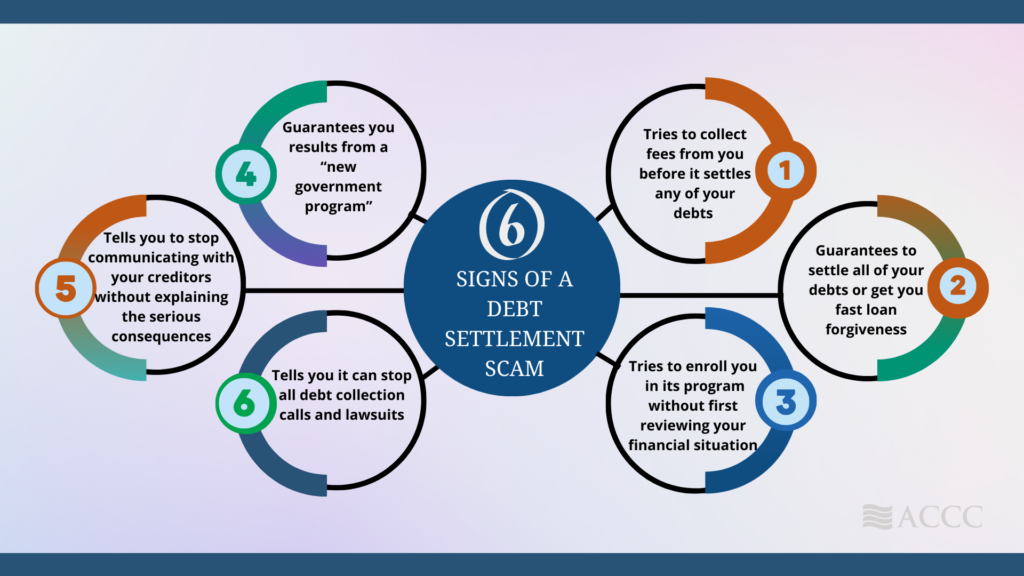

Signing up for a debt settlement program not only carries inherent risks but also exposes you to potential scams. Therefore, it’s essential to exercise caution and know precisely how to determine the authenticity of the program.

Debt Settlement Must Know Factors – Signs of a debt settlement scam must be carefully analyzed before you sign up.

Evaluate Settlement Services With Help From ACCC.

As a not-for-profit agency, ACCC is dedicated to helping consumers get out of debt– and stay out of debt for good. Here you’ll find free credit counseling and low-cost financial services, along with professionally certified credit counselors who can help you clearly evaluate your financial situation and pinpoint all the options available to you in addition to settlement services. Our counselors can walk you through the pros and cons of debt consolidation vs debt settlement, help to create a budget you can live with while you pay down your debt, and direct you to social services and educational resources that may be helpful on your journey to a debt-free future.

Debt Management: An Alternative to the Settlement Services.

When you’re ready take action to get out of debt and you don’t want to deal with settlement services or the debt settlement credit score impact, a debt management plan may be the right choice. Rather than refusing to pay your creditors and damaging your credit rating, a debt management plan lets you stay current with your payments while seeking to reduce interest rates, fees, and monthly payments to help you pay your debt off faster. A debt management plan also helps to simplify your financial life: you’ll make just one lump-sum payment every month to a fund at ACCC, and our team will take responsibility for paying all your bills on time for a small fee.

Under a debt management plan, most consumers are able to pay off their debt within five years or less, while also addressing the financial behavior and habits that got them into debt in the first place – which is unlikely to happen with a debt settlement services arrangement.