January 17, 2019 – By Megan Leonhardt

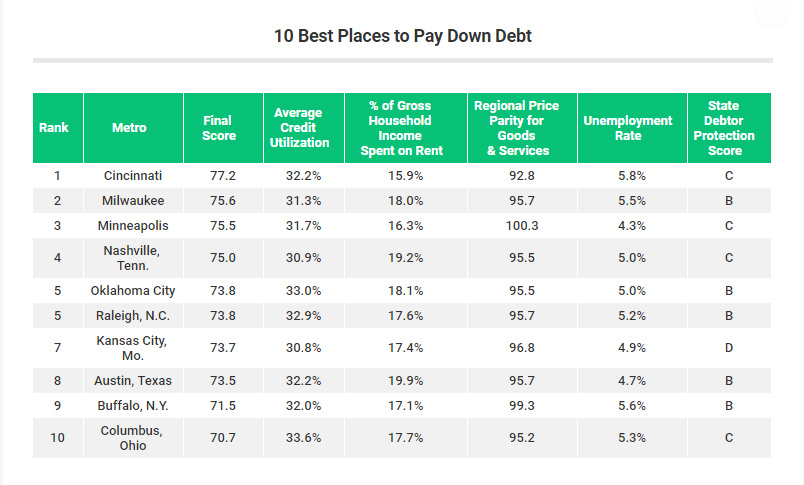

To find the best city to live in to pay down debt, LendingTree analyzed data in 50 of the biggest metro areas in the U.S. using a number of factors that can make it easier for locals to get out of the red.

Specifically, they looked at each city’s average credit utilization rate (the share of their available credit that individuals use), which experts recommend should be less than 30 percent. They also took into account housing costs in relation to income, unemployment rates and cost of living generally.

The city that scored highest in LendingTree’s analysis is Cincinnati, Ohio. It has a debt utilization rate that’s a bit higher than ideal (32.2 percent), but the costs of goods and services are lowest here. And the average resident spends just 15.9 percent of his or her income on housing.

Compare that to the high housing costs of cities like Miami and Los Angeles, where the average resident pays 28.6 percent and 25.6 percent, respectively.

Milwaukee, Minneapolis, Nashville and Oklahoma City round out the top five cities where it’s easier for residents to pay down debt. All of these cities have credit utilization rates of around 30 percent and below-average unemployment rates.

How to Tackle Debt

If you’re in the red, you’re definitely not alone: The average American has about $38,000 in debt, up $1,000 from a year ago, according to Northwestern Mutual’s 2018 Planning & Progress Study.

No matter where you live, it can help to assess where you’re at and then make a plan for how to pay off what you owe. Be clear about what you want and what’s achievable, Saundra Davis, a financial coach and adjunct professor at Golden State University, tells CNBC Make It.

And be realistic, she says. Don’t expect yourself to go immediately from saving $0 to putting away $400 a month. Start by trying to save $40.

Likewise, don’t worry if you can’t dedicate a huge share of your earnings towards paying off your loans. The nonprofit American Consumer Credit Counseling recommends allocating about 5 percent of your income towards that goal.

Once you’ve got a handle on your situation, it’s time to build new, lasting goals. Davis acknowledges that it’s not easy to shift your thinking. So start small. Save $5 and actually put it into savings, or cook dinner once a week and take the money you would’ve spent going out and deposit it.

“It truly is about changing your mindset and then creating different habits,” Davis says.

The key takeaway is that debt doesn’t have to be a life sentence, says CreditCards.com industry analyst Ted Rossman. Though it may require some hard work and planning, he tells CNBC Make It, “Everybody can get out of debt.”