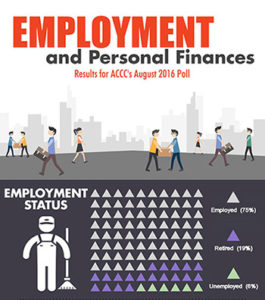

Although majority of respondents are employed, only 13 percent of consumers polled by American Consumer Credit Counseling are satisfied with their income.

Boston, MA – September 19, 2016

Of the respondents, only a slim majority (50 percent) are salaried, while slightly fewer (48 percent) are paid by the hour. Sixty-six percent of those respondents who receive a salary are vocationally trained or are trade workers. Of those who are paid hourly, 63 percent only have a high school degree.

“Many consumers are feeling as though their lack of income is holding them back,” said Steve Trumble, President and CEO of American Consumer Credit Counseling, which is based in Newton, MA. “Some consumers are taking on a second job to help pay off debt and start saving for a home.”

Only 13 percent of those polled by ACCC feel that their income is sufficient enough to achieve financial or lifestyle-related goals. The remaining 87 percent feel that their income is a major factor preventing them from doing things such as paying off debts, building savings, buying a house or car, starting a family or even just taking a vacation. Of those that are employed, 24 percent have a second job, freelance on the side or sell homemade goods in order to make extra money.

Of the employed respondents, 69 percent are contributing less than five percent of their income to retirement savings. Less than eight percent of respondents are contributing the recommended 10 percent or more to their retirement savings account. While fifty percent of those contributing more than five percent to their retirement savings are between the ages of 25 and 45.

Twenty-five percent of respondents with a household income greater than $200k have been with their current employer for more than 10 years.

The online poll of 173 participants was conducted by American Consumer Credit Counseling on the organization’s website, www.consumercredit.com. You can view an infographic illustrating the poll results here: https://www.consumercredit.com/debt-resources-tools/infographics/information/employment-and-personal-finances/

ACCC is a 501(c)3 organization that provides free credit counseling, bankruptcy counseling, and housing counseling to consumers nationwide in need of financial literacy education and money management. For more information, contact ACCC:

- For credit counseling, call 800-769-3571

- For bankruptcy counseling, call 866-826-6924

- For housing counseling, call 866-826-7180

- Or visit us online at https://www.consumercredit.com

About American Consumer Credit Counseling

American Consumer Credit Counseling (ACCC) is a nonprofit credit counseling 501(c)(3) organization dedicated to empowering consumers to achieve financial management through credit counseling, debt counseling, bankruptcy counseling, housing counseling, student loan counseling and financial education. Each month, ACCC invites consumers to participate in a poll focused on personal finance issues. The results are conveyed in the form of infographics that act as tools to educate the community on everyday consumer debt issues and problems. By learning more about financial management topics such as credit and debt management, consumers are empowered to make the best possible financial decisions to reach debt relief. As one of the nation’s leading providers of personal finance education and credit counseling services, ACCC’s certified credit advisors work with consumers to help determine the best possible debt solutions for them. ACCC holds an A+ rating with the Better Business Bureau and is a member of the National Foundation for Credit Counseling® (NFCC®). To participate in this month’s poll, visit ConsumerCredit.com and for more financial management resources visit https://www.consumercredit.com/debt-help/.