The goal is to head into retirement debt free. However, life happens and disrupts this. That’s why credit counseling for seniors is available when they have consumer debt.

Benefits of Credit Counseling for Seniors

Debt can happen to anyone at any age. Seniors face a bigger burden since their working years are more limited or already past. Credit counseling for seniors can help create a plan to eliminate debt. Additionally, anyone receiving quality credit counseling is educated and their financial literacy boosted. Finally, they walk away with a plan and goals to head into the future. If you know a senior struggling to manage their finances, counseling may be a great step for them to take.

Credit Counseling for Seniors in 3 Steps

Let’s say you need to help your parents go through credit counseling. First, help them find an agency, like ACCC. When choosing a credit counseling service, it’s important to look for a credit counseling agency that is non-profit and has been in business for at least seven years. Here are some other criteria that your debt relief agency should have:

- Licensed in your state.

- Charge no minimum fees and are prepared to waive your fees if you simply cannot afford to pay them.

- All the counselors should be certified.

- Member of one of these organizations: the NFCC or AICCCA.

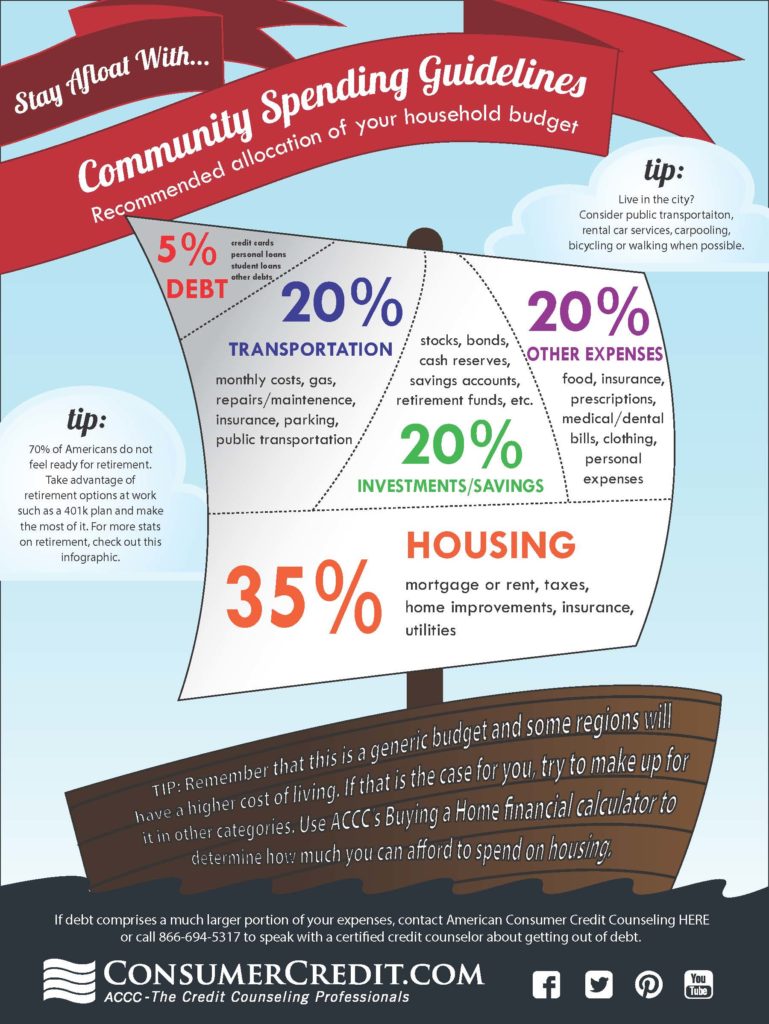

Next, you will go through a counseling session to determine where money is being spent. During the session, the debt counselor will organize and calculate each expense, interest rate, and other costs. Check out the infographic below to review the recommended community spending guidelines.

Finally, a recommendation will be made to your parents to enter a debt management plan, bankruptcy or simply follow a revised budget to deal with the debt.

No matter the age, a person’s finances can become derailed by debt. Credit counseling for seniors is a great way to help them get back on track.

If you know a senior struggling to manage their finances, have them schedule a free credit counseling session with ACCC today.