You might save money and pay off debt faster, but there are some limitations to debt settlement.

You might save money and pay off debt faster, but there are some limitations to debt settlement.

What is Debt Settlement

Debt settlement is a negotiation process where a debtor and a creditor agree on a reduced balance that will be considered a payment in full. Essentially, it’s a way to reduce your overall debt amount. You or a debt settlement company negotiate with your creditors to accept a lump sum that’s less than the total amount you owe. If successful, it can lead to debt relief without having to declare bankruptcy. However, it’s important to note that it can negatively impact your credit score and may not always be the best or only solution for managing debt. Unlike debt management plans, debt settlement programs are typically offered by for-profit organizations.

How Does the Debt Settlement Process Work?

In debt settlement, the person in debt stops paying the people they owe money to. Instead, they put their money into a special savings account that the debt settlement company sets up for them. While this is happening, the debt settlement company talks to the people they owe money to, trying to get them to agree to accept a one-time payment. This payment is less than the total amount of money they owe.

These negotiations can be drawn up over several months, even years, with no guarantee of success. If successful, however, the savings can be significant. It’s not uncommon for creditors to accept a settlement of 50% or less of the original debt, especially if the alternative is the debtor declaring bankruptcy and the creditor receiving nothing.

In the process of settling your debt, the company helping you will ask you to stop giving money to those you owe and instead, start putting money into a savings account. This means regularly saving money in an account that the company can use to pay off your debt or gather the fees you owe them. You might fall behind on payments and your credit score could drop significantly.

If a settlement is agreed on, you’ll need to agree to new terms, a one-time smaller payment, lower monthly payments, or letting go of the debt altogether. For the settlement process to continue, you have to agree to these terms. However, remember, you don’t have to say yes to any conditions that you’re not comfortable with. Depending on the way the debt was settled, you might have to keep giving money to the company dealing with your debt until you’ve paid off all your debt.

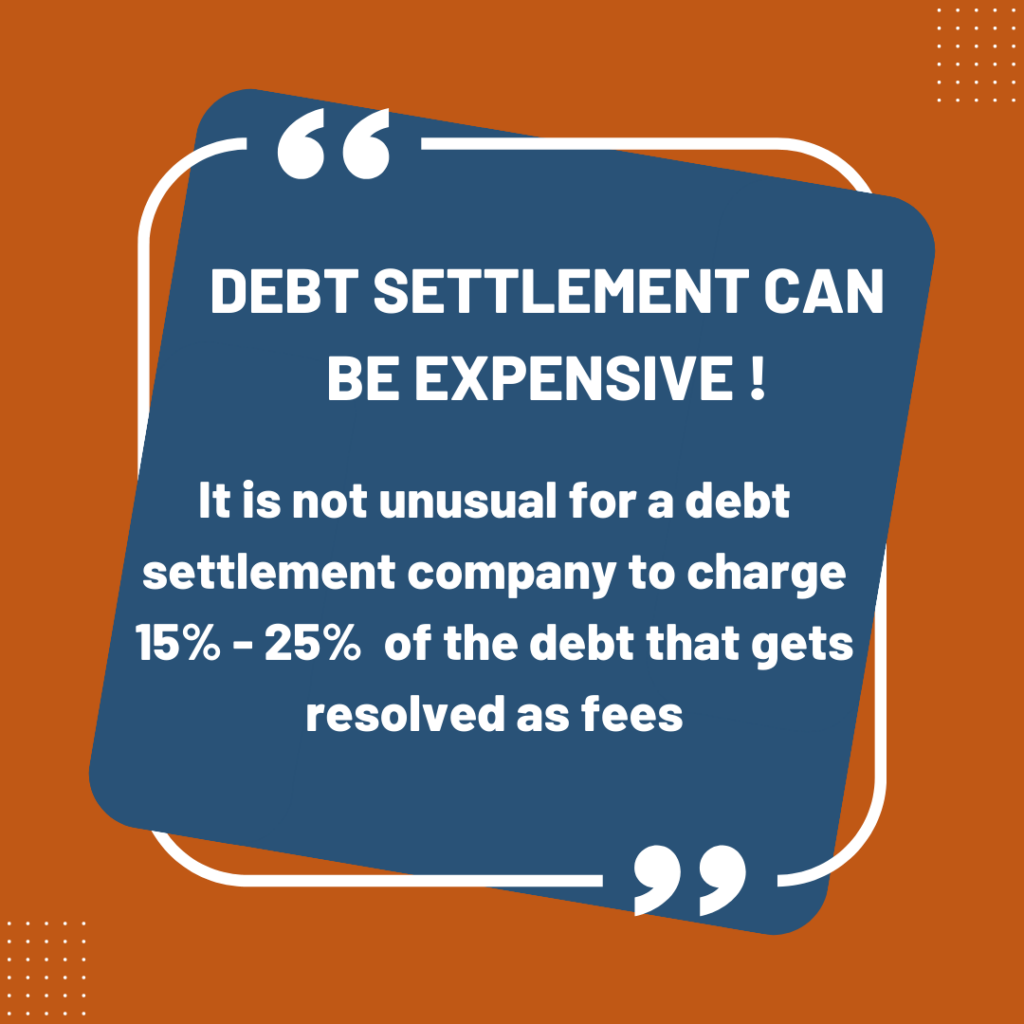

Fees Charged by Debt Settlement Companies

Debt settlement companies offer a valuable service, but they do not work for free. These companies usually charge a fee based on a percentage of the enrolled debt or the amount of debt reduced.

Disadvantage of Debt Settlement – The risk of debt settlement might not always outweigh the benefits. Therefore, choose wisely

In some cases, these fees can be substantial, reducing the overall savings gained from the debt settlement. Additionally, if the debt settlement company is unsuccessful in their negotiations, the debtor may still be liable for these fees.

Before working with a debt settlement company, it’s crucial to understand their fee structure and consider it as part of the overall cost of the debt settlement process.

Read More>> Does debt settlement affect your credit?

How Does Debt Settlement Impact My Finances?

Impact on Credit Score

While the potential for reduced debt is attractive, debt settlement is not without its drawbacks. One of the most significant is the effect on your credit score.

Because the debt settlement process involves halting payments to creditors, your credit report will show these missed payments. This activity can result in significant harm to your credit score. Even after the debt is settled, the settlement will stay on your credit report for seven years, marking a negative note on your credit history.

This negative impact on your credit score can limit your access to credit in the future, or make any new credit more expensive due to higher interest rates from perceived lending risk.

Tax Implications of Debt Settlement

The potential tax implications of debt settlement are often overlooked but is very important. The Internal Revenue Service (IRS) usually considers forgiven debt as income. As a result, you might need to report the forgiven amount as income when filing taxes, leading to additional financial responsibility that you may not have considered.

However, exceptions to this rule exist. For instance, if you are insolvent, that is, the debts are more significant than the assets at the time of the settlement, you may not have to pay taxes on the forgiven amount. As these tax laws can be intricate and subject to change, it’s advisable to consult a tax professional before proceeding with debt settlement.

Pros and Cons of Debt Settlement.

On the positive side, debt settlement may help you get out of debt more quickly and for less than the total amount you currently owe. When you work with a settlement company, their representatives will handle communications with your creditors, relieving you of the responsibility of some difficult conversations. Some other benefits to debt relief through debt settlement are:

- Reduced Debt Amount: The most significant advantage of debt settlement is the potential for reducing the total amount of debt. If successful, creditors accept a lump-sum payment that’s less than the full amount owed, effectively forgiving the remainder.

- Avoid Bankruptcy: Debt settlement can serve as an alternative to bankruptcy, which has a more severe impact on your credit score and public record.

- Single Payment: Instead of juggling multiple payments to different creditors each month, you’d make a single payment into a dedicated account managed by the debt settlement company.

On the negative side, debt settlement is not guaranteed to work. Your creditors are under no obligation to settle your debt for less than what you owe. And because debt settlement involves not paying your bills for a number of months, you may end up with additional penalties and interest, legal bills, and calls from collection agencies. Debt settlement can be expensive, too. You may pay as much as 25% of the money you save to the settlement company, and you’ll likely have to pay taxes on those savings as well.

- Credit Score Impact: Debt settlement can have a negative effect on your credit score. Ceasing payments during the negotiation process results in delinquencies reported to the credit bureaus.

- Potential Tax Consequences: The IRS may consider forgiven debt as taxable income. Depending on your individual circumstances, this could lead to a higher tax bill.

- Fees: Debt settlement companies charge for their services, typically a percentage of the debt enrolled or of the debt reduced. These fees can sometimes be significant.

- No Guarantee of Success: Creditors are not required to agree to negotiate a debt settlement. You could potentially damage your credit score only for negotiations to fail.

- Accumulation of Late Fees and Interest: While you’re setting aside funds for the settlement, your debts continue to accrue interest and late fees, increasing the total amount owed.

- Collection Calls and Lawsuits: Since you stop making payments to your creditors during this process, you may face increased collection calls or even legal action from them.

Before choosing debt settlement, it’s vital to consider these pros and cons, possibly consult with a financial advisor, and explore other debt relief options like credit counseling, debt consolidation, or even bankruptcy in more severe cases.

What are Some Alternatives to Debt Settlement?

Given the drawbacks, it’s crucial to consider alternative options before deciding on debt settlement. These alternatives could include credit counseling, debt consolidation, and bankruptcy.

Credit counseling agencies such as American Consumer Credit Counseling can provide valuable advice and may be able to work with your creditors to lower your interest rates or payments. Debt consolidation can simplify payments and potentially lower your interest rate. Bankruptcy, while having severe implications for your credit, can provide a clean slate and is sometimes the best option for individuals with overwhelming debt.

It’s also possible to negotiate with creditors directly. Some creditors may be willing to work out a payment plan or even settle your debt directly if they believe the alternative is you defaulting on your debt.

Considering Debt Settlement? Talk to ACCC.

Before you enter a debt settlement arrangement, it’s helpful to get debt settlement advice by talking to financial professionals who can help you decide if this is the right course for you. At American Consumer Credit Counseling (ACCC), we offer free credit counseling sessions where you can work with professionally certified counselors to take stock of your finances, consider all your options, and choose the most advantageous path out of debt. Our counselors can help you understand the ins and outs of credit settlement and the debt settlement credit score impact, and determine whether debt settlement seems like the best choice for your financial situation.

An Alternative to Debt Settlement: Debt Management.

As a nonprofit organization, ACCC is dedicated to helping consumers get out of debt fast and live debt-free in the future. That’s why, for many clients who come to us for free credit counseling, we recommend a debt management program over debt settlement.

With a low-cost debt management plan, we’ll help you create a budget you can live with while you pay down your debt as quickly as possible. Rather than paying multiple creditors each month, you’ll make one payment to ACCC, and we’ll pay all your bills on your behalf. This simplifies your finances, makes it easier to stay current with creditors, and gives us the opportunity to seek reductions in interest rates, fees, and payments that can help you pay your debt off more quickly. We’ll also guide you to educational materials and resources that can help you learn more about managing money and developing financial habits that will help you learn to live without debt.

Get Your Debt Management Plan