We face embarrassing social situations on a daily basis. And if money is involved it becomes even more awkward! How do you split a bill at a restaurant? Does it make sense to lend money to a friend? When should you tip? These are just a few questions that can make for awkward moments. Following proper money etiquette is difficult as individuals’ perspective varies. However, it’s good to know some standard tips to be smart, polite, and thoughtful when it comes to money etiquette. As a nonprofit credit counseling agency, ACCC has advice for you.

Money Etiquette – Tips That Come in Handy

We spend a lot of time talking about money. And virtually everyone has experienced an awkward social situation that involves finances. While these situations and conversations are tricky, it’s important to make a commitment to follow proper money etiquette. That way consumers not only have the ability to save money effectively and work on their debt management, they can spend it wisely in the appropriate situations.

Tips to Practice Proper Money Etiquette

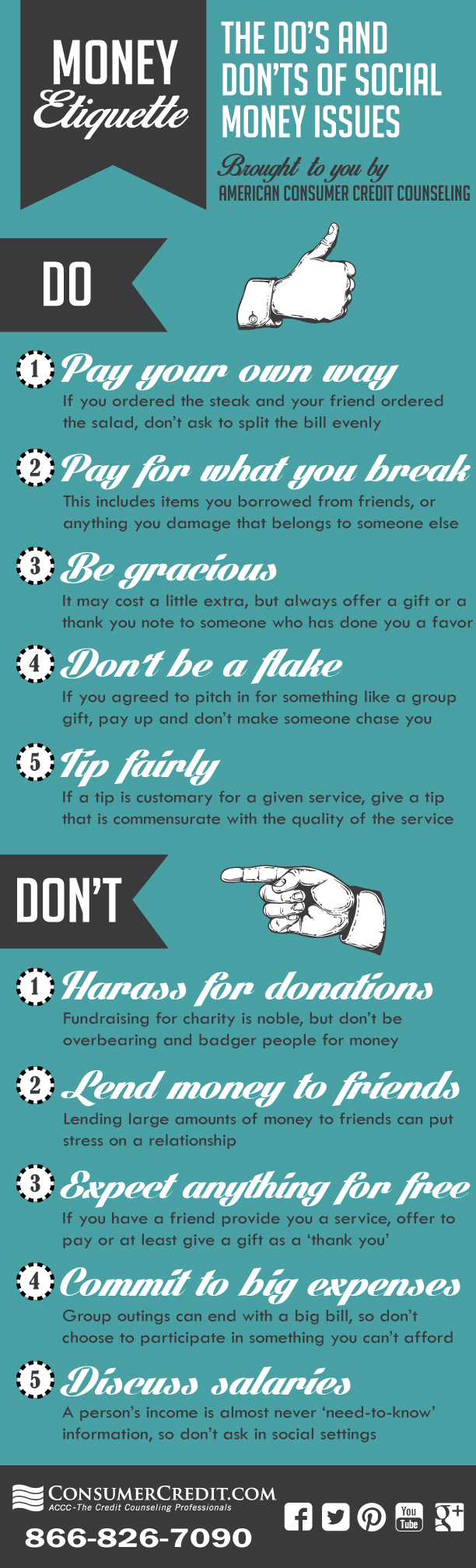

Pay Your Own Way: In your next dinner out, if you order the steak and your friend orders the salad, it’s only fair that you pay for your own food!

Pay for What You Break: We all borrow things and sometimes accidents happen. Things break or get lost! But if and when they do it’s only right that you replace the item or pay to repair it if possible.

Be Gracious: Sometimes, it may cost a little extra, but always offer a gift or at least a thank you note to someone who has done you a favor.

Don’t Be a Flake: Make sure to pay up for something you agreed to pitch in for. If you committed to being a part of a group gift or dinner, don’t make someone have to track you down or chase you for your share. It’s awkward for the person asking money to remind you of your dues.

Tip Fairly: If a tip is customary for a given service, give a tip that is commensurate with the quality of the service.

Be Respectful: Fundraising for charity is noble. But don’t be overbearing and badger people for money. No one likes to be repeatedly prodded for contributions.

Be Cautious: Lending large amounts of money to friends can put stress on a relationship. There is no need to create awkward situations unnecessarily. It’s best to separate friendships and finances.

Be Appreciative: If a friend provides you with a service (not a favor, but their professional work), offer to pay or at least give a gift as a “thank you.” They may give you a nice discount or turn you down completely for compensation.

Be Aware: Group outings can end with a big bill, so don’t choose to participate in something you can’t afford.

Don’t Discuss Salaries: A person’s income is almost never “need-to-know” information, so don’t ask in social settings.

Here is an infographic to illustrate these tips:

Money is an issue consumers often grapple with, whether it is how to earn it, save it, or spend it wisely. It’s not difficult to avoid awkward situations by being fair and conscientious. Proper money etiquette is the foundation to good money habits resulting in less consumer debt.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.