Debt Management Plans: The Smart Path to Financial Freedom

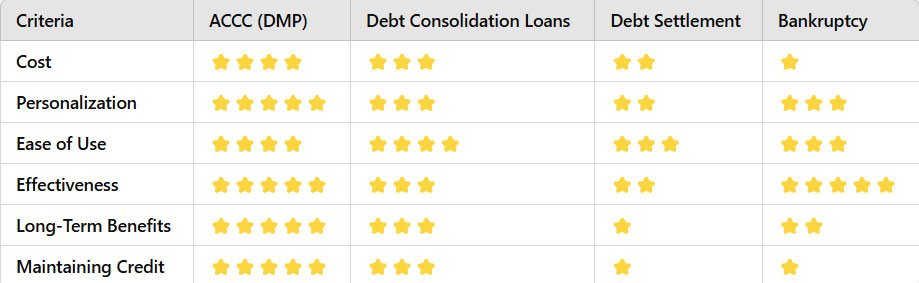

At American Consumer Credit Counseling (ACCC), our Debt Management Plans (DMPs) offer a clear and effective way to take back control of your finances. Unlike options like debt consolidation loans, debt settlement, or bankruptcy, DMPs provide a client-focused solution that prioritizes your financial well-being.

Take the First Step

Discover how ACCC’s Debt Management Plans can help you achieve financial freedom responsibly. Contact Us Today!