According to recent poll by ACCC many consumers are not aware of recommended spending and budgeting guidelines for housing, transportation, medical and other expenses.

Boston, MA – October 13, 2016

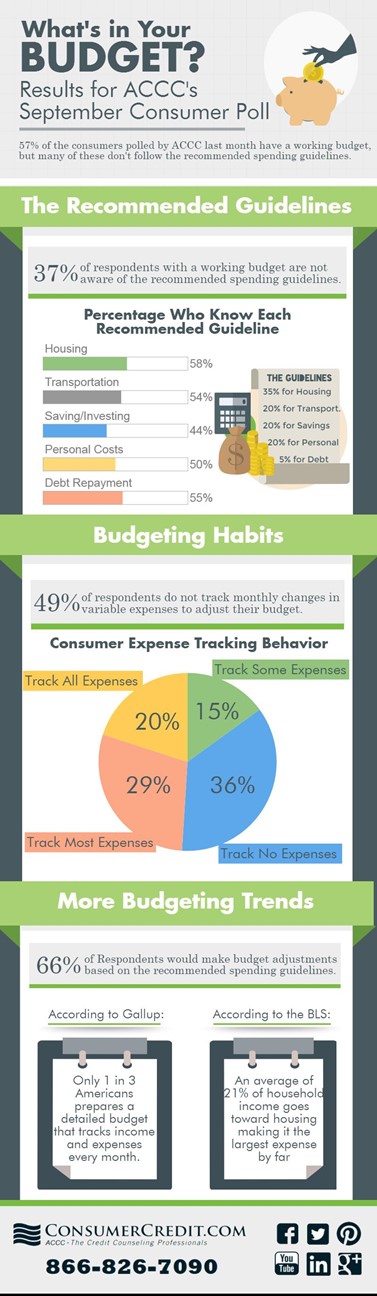

Financial experts have established basic guidelines to help consumers determine where they should spend their money. According to these guidelines, individuals should spend no more than 35 percent of their income on housing, 20 percent on transportation, 20 percent on personal expenses such as food, clothing and entertainment, 15 percent on debt and another 10 percent on investment and savings.

According to the ACCC survey, 66 percent of respondents who currently have a working budget said they would consider adjusting their spending habits based on the recommended guidelines. Forty-nine percent said they do not track monthly changes in variable expenses in order to make adjustments.

“Spending guidelines can be an important tool to help consumers plan their budgets and engage in responsible financial planning,” said Steve Trumble, President and CEO of American Consumer Credit Counseling, which is based in Newton, MA. “Budgets show exactly how much money you have, where it is being spent and can help you find ways to cut back and save.”

The good news is that more budget-conscious consumers are creating budgets and keeping track of their spending. According to the ACCC survey, 57 percent of respondents said they have a working budget and 78 percent of those respondents said they keep track of all or most of their expenses. Of the respondents with a working budget, 37 percent said they are not aware of the recommended spending guidelines for a household budget.

According to the Bureau of Labor Statistics, the average American spends about 33 percent of their monthly budget on housing, 17 percent on transportation, 13 percent on food, 11 percent on personal insurance, 8 percent on healthcare, 7 percent on miscellaneous items, 5 percent on entertainment and 3 percent on both cash contributions and clothing.

Seventy-five percent of respondents with a working budget have an income between $20k and $100k. Seventy-three percent of respondents with a working budget were 35 or older and 26 percent were between 25 and 34.

The online poll of 157 participants was conducted by American Consumer Credit Counseling on the organization’s website, www.consumercredit.com. You can view an infographic illustrating the poll results here:

https://www.consumercredit.com/debt-resources-tools/infographics/money-management-infographic/whats-in-your-budget/

ACCC is a 501(c)3 organization that provides free credit counseling, bankruptcy counseling, and housing counseling to consumers nationwide in need of financial literacy education and money management. For more information, contact ACCC:

- For credit counseling, call 800-769-3571

- For bankruptcy counseling, call 866-826-6924

- For housing counseling, call 866-826-7180

- Or visit us online at https://www.consumercredit.com

About American Consumer Credit Counseling

American Consumer Credit Counseling (ACCC) is a nonprofit credit counseling 501(c)(3) organization dedicated to empowering consumers to achieve financial management through credit counseling, debt counseling, bankruptcy counseling, housing counseling, student loan counseling and financial education. Each month, ACCC invites consumers to participate in a poll focused on personal finance issues. The results are conveyed in the form of infographics that act as tools to educate the community on everyday consumer debt issues and problems. By learning more about financial management topics such as credit and debt management, consumers are empowered to make the best possible financial decisions to reach debt relief. As one of the nation’s leading providers of personal finance education and credit counseling services, ACCC’s certified credit advisors work with consumers to help determine the best possible debt solutions for them. ACCC holds an A+ rating with the Better Business Bureau and is a member of the National Foundation for Credit Counseling® (NFCC®). To participate in this month’s poll, visit ConsumerCredit.com and for more financial management resources visit https://www.consumercredit.com/debt-help/.