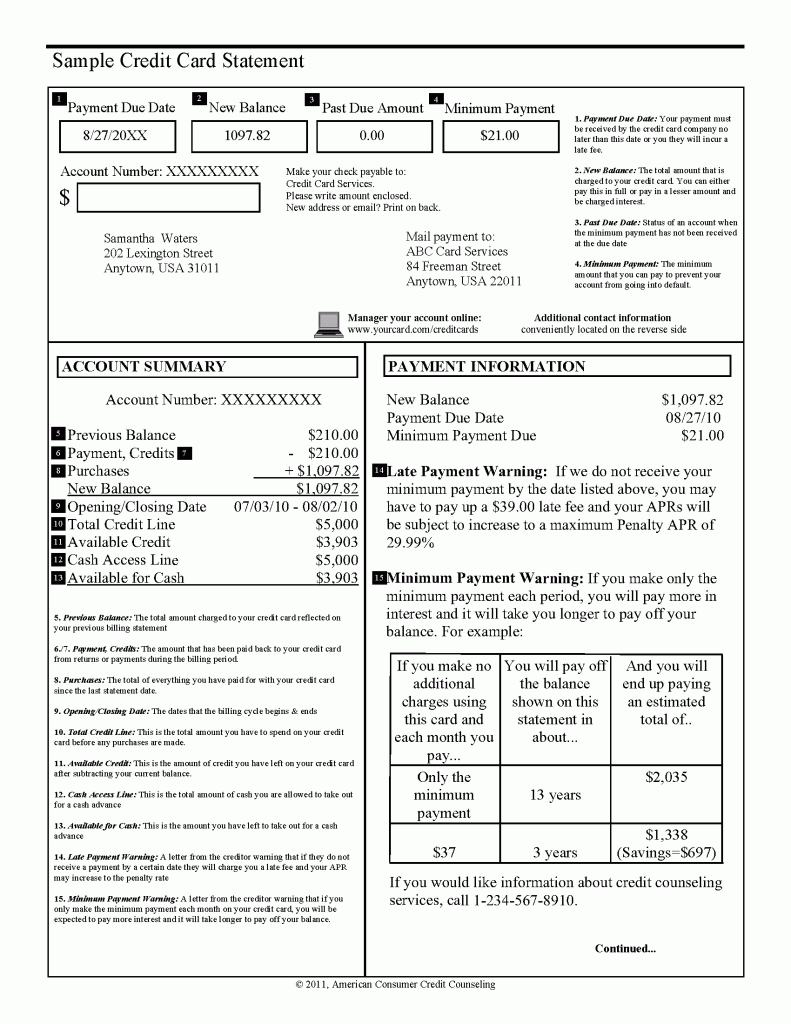

As of today, it’s been 2 years since the CARD Act (Credit Card Accountability, Responsibility and Disclosure) was enacted. Seems like only yesterday she was crawling on the floor eating stale cheerios. Memories… Anyway, the CARD Act employed several new restrictions and rules regarding how credit card companies operate and how they communicate with you. One of the major components is the updated statement. Our credit counseling advice is to take the time to understand it. Your creditors must now provide certain helpful information to you regarding your account balance, fees, and repayment options. Let’s take a look at a sample credit card statement.

Here are some other major changes we’ve seen…

- Your credit card company must send you a notice 45 days before they can increase your interest rate, change certain fees (such as annual fees, cash advance fees, and late fees) that apply to your account, or make other significant changes to the terms of your card.

- Your interest rate cannot be changed within the first 12 months of opening an account (exceptions for promotional rates that may only be for 6 months, or if you are 60 days late on a payment)

- You must tell your credit card company that you want it to allow transactions that will take you over your credit limit. Otherwise, if a transaction would take you over your limit, it may be turned down. If you do not opt-in to over-the-limit transactions and your credit card company allows one to go through, it cannot charge you an over-the-limit fee.

- If you are under 21, you will need to provide proof that you are able to make payments, or you will need a cosigner to open a credit card account.

- Your credit card company must mail or deliver your credit card bill at least 21 days before your payment is due.

- Your payment due date will be the same each month.

This is just the tip of the iceberg. The CARD Act brought about several more changes to the credit card industry.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.