Recent reports from the National Retail Federation indicate Mother’s Day spending will decrease by more than three percent from last year as consumers turn to budget-friendly alternatives.

Boston, MA – May 5, 2014

As Mother’s Day approaches, leading financial education nonprofit American Consumer Credit Counseling released its list of budget-friendly alternatives to celebrate and honor Mom this holiday. ACCC’s Mother’s Day savings resource comes as consumer spending is expected to decline by over three percent from last year with consumers shelling out an average of $162.94, according to a recent survey conducted by the National Retail Federation.

As Mother’s Day approaches, leading financial education nonprofit American Consumer Credit Counseling released its list of budget-friendly alternatives to celebrate and honor Mom this holiday. ACCC’s Mother’s Day savings resource comes as consumer spending is expected to decline by over three percent from last year with consumers shelling out an average of $162.94, according to a recent survey conducted by the National Retail Federation.

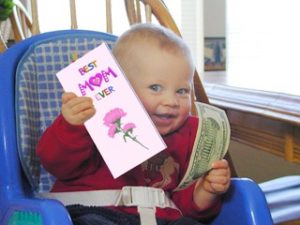

“Consumers don’t have to spend hundreds of dollars when it comes to celebrating Mom,” said Steve Trumble, president and CEO of American Consumer Credit Counseling. “A hand-written card, some hand-picked flowers, a home-made gift, or any thoughtful act goes a long way. Consumers must remember, love isn’t measured in dollars, and Mother’s Day is all about showing mom appreciation, whatever the gesture might be.”

Store-bought gifts, cards, and flowers can add up to make for an expensive Mother’s Day. But you don’t need to break your budget to show your mother the appreciation she deserves. Being creative and thoughtful can have more of an impact than an expensive gift.

“It’s important for consumers to show their gratitude and appreciation on Mother’s Day, but doing so does not have to mean breaking the bank and veering off course from a budget,” said Trumble. “By following these tips and money-saving ideas, consumers can stay on track with their budget while still pleasing their mothers with a sincere gesture or gift.”

American Consumer Credit Counseling works with consumers every day to help them overcome debt through money management and budgeting. The organization has put together some ideas for a Mother’s Day gift that are easy on the wallet, but still convey appreciation.

For your mom:

- Wash her car

- Do some lawn-mowing, landscaping, gardening, etc.

- Make her breakfast/lunch/dinner. Make it a potluck and invite the whole family over.

- Take her out shopping for something nice. Sure you’re buying something, but the time together will mean more than the item.

- Repair something of hers that has sentimental value.

- Frame an old photo and write a nice message on the back.

- Spend quality time with her – according to a survey conducted by Ebates.com in March, 50 percent of moms listed few hours of your undivided attention as their number one gift choice.

For your wife:

- Breakfast in bed.

- Make a memory book of photos and other memorable clippings from your past.

- Take her out for the day. Go for a hike, have a picnic, go to a lake/beach, take a road trip, etc. You might be able to find some free events, like a concert or a play.

- Handle all of the housework. Take the kids on errands, clean up the house, do some repairs, cook the meals, etc.

- If you’re computer-savvy, make a tribute video or slideshow and burn it to DVD.

ACCC’s certified and experienced counselors offer a variety of financial education, counseling, and debt management services to help consumers achieve long-term financial health and stability. These financial education programs enable consumers to better understand and manage their finances.

ACCC is a 501(c)3 organization, that provides free credit counseling, bankruptcy counseling, and housing counseling to consumers nationwide in need of financial literacy education and money management. For more information, contact ACCC:

- For credit counseling, call 800-769-3571

- For bankruptcy counseling. call 866-826-6924

- For housing counseling, call 866-826-7180

- Or visit us online at ConsumerCredit.com

About American Consumer Credit Counseling

American Consumer Credit Counseling (ACCC) is a nonprofit credit counseling 501(c)(3) organization dedicated to empowering consumers to achieve financial management and debt relief through education, credit counseling, and debt management solutions. In order to help consumers reach their goal of debt relief, ACCC provides a range of free consumer personal finance resources on a variety of topics including budgeting, credit and debt management, student loans, homeownership, identity theft, senior living and retirement. Consumers can use ACCC’s worksheets, videos, calculators, and blog articles to make the best possible decisions regarding their financial future. ACCC holds an A+ rating with the Better Business Bureau and is a member of the Association of Independent Consumer Credit Counseling Agencies. For more information or to access free financial education resources, log on to ConsumerCredit.com or visit TalkingCentsBlog.com.